President Tilghman’s record as steward of the University’s finances is marked by a large increase in financial aid and her response to the financial crisis of 2008–09, which sent the endowment into a deep dive and required significant budget cuts.

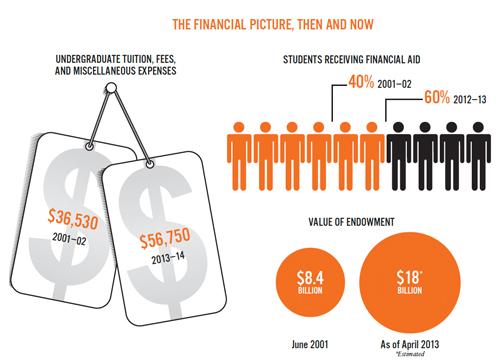

In 2001, the year Tilghman became president, 1,835 undergraduates, or 40 percent of the student body, received financial aid, according to the Office of Finance and Treasury. By 2012, that had increased to about 3,100 students, or 60 percent of the student body. The average scholarship increased, after adjusting for inflation, 60 percent to more than $36,000, outpacing the increase in attendance costs. As a result, the net arrival cost of attendance for recipients of aid decreased, after adjusting for inflation, to about $17,680.

Ballooning financial aid — which accounts for 7.6 percent of overall spending, compared to about 4.7 percent when Tilghman took office — was driven in part by a decision made before she became president: to offer all aid students a package that included only grants and work-study, without loans. Many University officials consider Tilghman’s ability to grow the financial-aid program through the economic ups and downs of the past few years to be a landmark achievement of her tenure. Graduate students also benefited: Graduate-school fellowships grew from 5.1 percent to 6.6 percent of the budget.

The University suffered what Tilghman described as “a body blow” in 2008 amid the global financial crisis, when the endowment lost 23 percent of its value. University leaders predicted it could take a decade to make up the loss, and Princeton implemented an austerity plan, cutting $170 million in spending. Raises were halted for employees making more than $75,000; hiring was reduced; adjunct faculty members and some staff members were let go, and retirement encouraged. Princeton also reduced its 10-year capital-spending plan from $3.9 billion to $2.9 billion.

The rebound has been swifter than many anticipated. Overall, under Tilghman’s tenure, Princeton’s endowment increased from $8.4 billion to just over $18 billion in April, according to an estimate by Andrew Golden, president of the Princeton University Investment Co. The investment return under Tilghman averaged 9.2 percent a year, compared to a 4 percent average return for the Standard & Poor’s 500, he said.

“The real mark that she had was the steadiness that she fostered during the global financial crisis,” said Golden. “I appreciated there was never any finger-pointing about how did we take a such short-term hit. It was all: What could we do to make this better from here?”