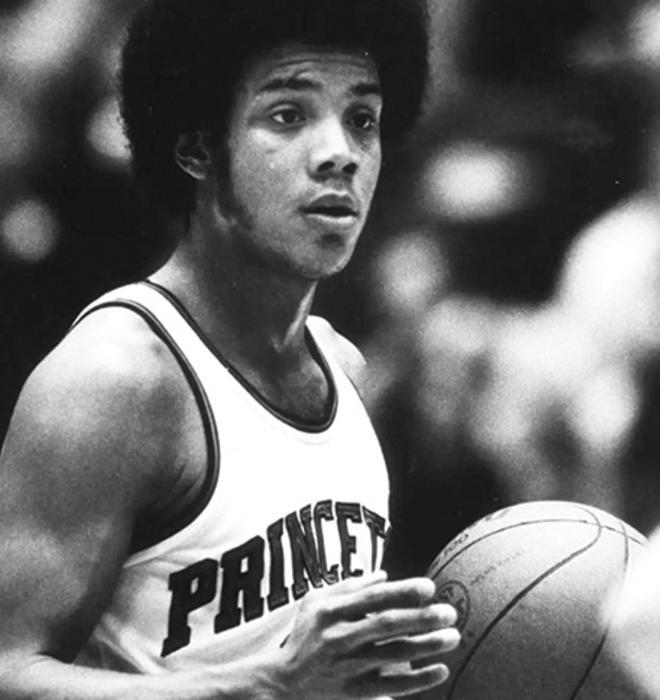

John W. Rogers Jr. ’80: A Gift of Stocks at Age 12

For his 12th birthday, John W. Rogers Jr. 80’s father bought him blue-chip stocks instead of toys. More stocks followed at Christmastime and subsequent birthdays. The gifts — along with the dividend checks his father let him keep — ignited a love of investing.

Rogers was the only child of John Rogers Sr., who flew combat missions in World War II with the Tuskegee airmen, the military’s first squadron of Black pilots. He met Rogers’ mother, Jewel Lafontant, on the first day of law school at the University of Chicago in 1943. She was the first Black woman to graduate from the law school, and later the first woman and first Black person to serve as U.S. deputy solicitor general. Rogers Sr. was a judge in Chicago’s juvenile court system. Their son liked to do jigsaw puzzles and read quarterly reports of the companies for which he owned stocks.

At Princeton, Rogers’ basketball teammates teased him because, recalls Stephen Mills ’81, “He was the only player who had a stockbroker.” At the beginning of his sophomore year, his prospects of making the varsity team were slim. “I had already told my parents I was leaving. I was going to come home and play for the University of Chicago,” Rogers recalls. Instead, legendary coach Pete Carril gave him “the last uniform” for the team. “John was not a star, but he was scrappy,” Mills says. “He never took a day off.” By senior year, he was the team’s captain.

Just three years after graduating, at the age of 24, Rogers founded the first Black-owned money management firm in the country, Ariel Investments. He based much of the company’s philosophy on lessons learned from Carril, “by far the best teacher I’ve ever had,” Rogers says. Carril was known for coaching “the Princeton offense” in which players keep passing the ball, wearing down the defense as they work to find the best available shot. The strategy usually resulted in low-scoring games. A top player “might only score 14 points in a game at Princeton because of the style of play,” Mills says. Personal glory was sacrificed for the sake of a team victory.

Inspired by Carril’s approach, Rogers embraced an investment strategy marked by patience — Ariel holds stocks far longer than most firms. And he learned to value “thinking about your teammates first,” which led to his many initiatives to mentor young people and people of color. (The conference room named for Carril at Ariel’s offices is where President Barack Obama’s transition team began assembling the government after his 2008 election.)

Rogers experienced a once-in-a-lifetime moment of glory on the basketball court in 2003 at a camp run by retired NBA superstar Michael Jordan, who every year challenged attendees to play him in a game of one-on-one, up to three points. Rogers stepped up and scored two points against Jordan, who quickly evened the score to 2-2. And then, miraculously, Rogers made a left-handed layup to win the game. It is thought to be the first time someone at the camp defeated Jordan.

No responses yet