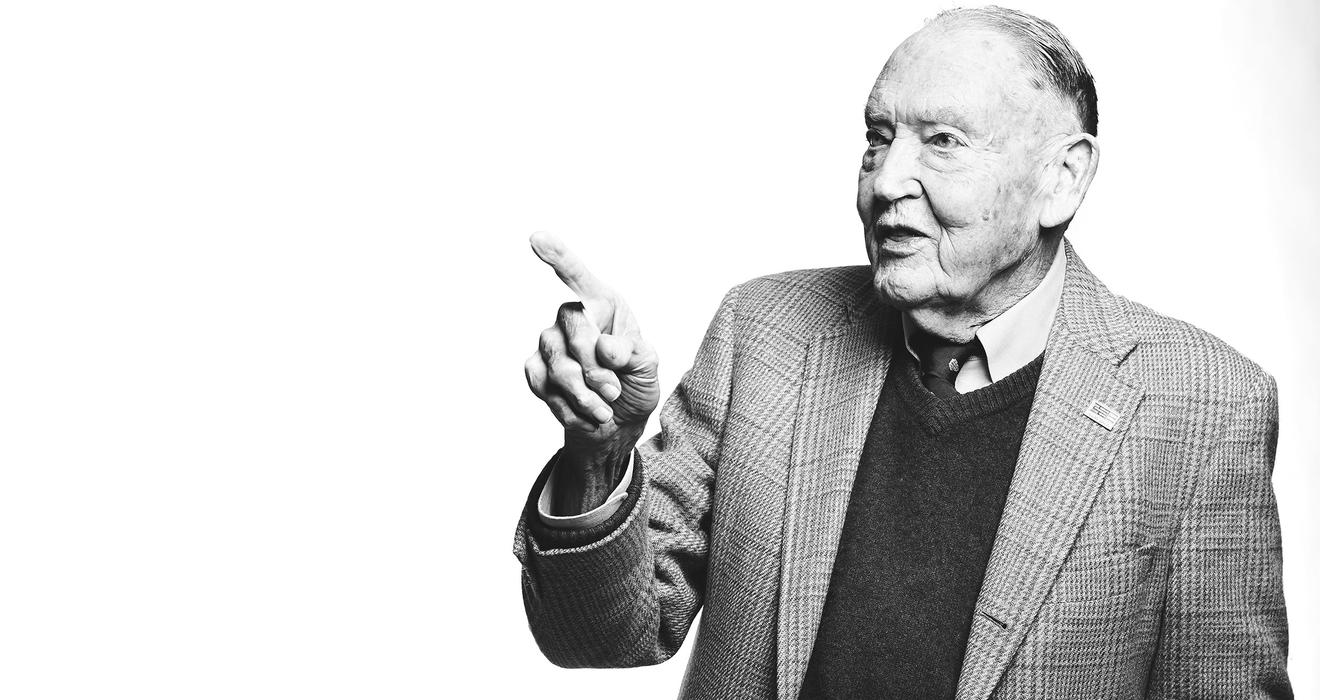

These days, the term “disrupter” is thrown around loosely. Yet when it comes to describing John C. Bogle ’51, the father of index investing, that label may not be applied enough. “Jack was without question one of the most disruptive forces in finance in the last century,” says Robert Arnott, chairman of the global asset-management firm Research Affiliates, who counted Bogle as both competitor and mentor.

Bogle didn’t actually invent the game-changing innovation he championed, though the concepts that underpinned indexing were rooted in his Princeton thesis. Two other firms had tested variations of index funds a few years before the Vanguard Group, the mutual-fund company Bogle founded, launched the Vanguard 500 in 1976.

But Bogle’s index fund — which bought and held all the stocks in the S&P 500 index, rather than trying to pick the most promising ones — was the first such vehicle available to the masses, and it changed the way Americans save and invest for retirement.

Like most disrupters, Bogle was ridiculed for his ideas. His critics, who called indexing “Bogle’s Folly,” could not understand why any investor would want to “settle” for average returns by owning every stock in a market. What they failed to consider was that the high costs associated with stock picking make it exceedingly difficult to beat the market consistently over time. Bogle understood this, as well as the fact that index funds could simplify the investment process, which helped democratize Wall Street and lower the cost of investing, forcing others in the industry to slash costs.

Bogle was known as “Saint Jack” — by his supporters for being the resolute patron saint of individual investor rights and by his opponents for relentlessly proselytizing the virtues of indexing to anyone within earshot, including the very portfolio managers that his index funds threatened. “My guess is that he was considered one of the biggest royal pains of anyone in the industry,” adds Jeremy Grantham, who helped develop the first index fund for institutional investors in the early 1970s.

Bogle wasn’t passionate solely about his work. He was “relentless about ideas” but also fiercely devoted to his six children and 12 grandchildren, notes Anne Sherrerd *87, Bogle’s niece. His passion for life grew even stronger after he received a heart transplant in 1996 at the age of 66. In 2016, Bogle’s family threw a 20th-birthday party for his transplanted heart. “Uncle Jack got up and gave this very moving talk about those 20 years and what a gift it was — and how important it was for him to use those 20 years well,” Sherrerd says.

And he did, not just for his himself, his family, or his legacy. Bogle, who attended Princeton on scholarship and sweat — he waited tables and worked at Princeton’s athletic department’s ticket office while on campus — continues to give back through the Bogle Brothers Scholarships, which he established at Princeton and the Blair Academy in honor of his brothers, William Yates Bogle and David Caldwell Bogle. He contributed a dorm in Butler College and was a big supporter of the Pace Center for Civic Engagement, where a program enabling students to pursue summer service projects is named in his honor.

In business, Bogle “put an important emphasis on putting clients first and making profits as an investment manager a distant second,” says Grantham. Why? In his 2008 book Enough, Bogle described what drove him to challenge the investment community: “Because what I’m battling for — building our nation’s financial system anew, in order to give our citizen/investors a fair shake — is right,” he wrote. “Call it idealism, and it’s as strong today as — maybe even stronger than — it was when I wrote that idealistic Princeton thesis 57 years ago.”

Paul J. Lim ’92, former deputy editor at Money magazine, is vice president of BackBay Communications.

MAY 8, 1929 | JAN. 16, 2019

No responses yet