When Paul A. Volcker ’49 passed away in December at the age of 92, Princeton lost one of its greatest sons and the nation lost one of its greatest Americans — in any walk of life.

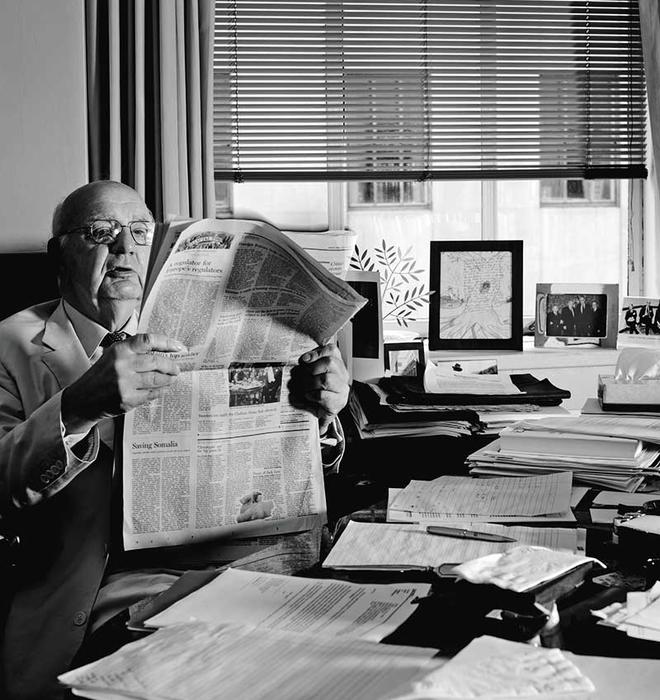

Paul is best known as the Federal Reserve chairman (from 1979 to 1987) who conquered inflation with tight money. His immediate predecessors thought that job was too difficult, but he proved them wrong — with his combination of an iron will, unquestioned integrity, a somewhat gruff demeanor, and clouds of smoke from cheap cigars.

Critics called him stubborn and unyielding (and worse!) as the economy became a casualty in the war against inflation, and he did view winning that war as a moral imperative. But when he saw that inflation was coming down and the economy was in dire straits in the summer and fall of 1982, he reversed course and cut interest rates sharply. That reversal helped usher in one of the longest economic expansions in U.S. history.

When it looked like the Reagan administration was preparing to push Paul out in June 1987, I wrote a column in BusinessWeek entitled, “Paul Volcker was the Babe Ruth of Central Banking.” He was. Despite having criticized his policies on several occasions, I wrote, “I reacted to the idea of replacing Volcker as the Boston Red Sox should have responded when the Yankees requested a trade for Babe Ruth: out of the question.”

Steering the Fed through that parlous time was no doubt his signal achievement, but far from his only one. Before that, he served as president of the Federal Reserve Bank of New York. And before that, he was undersecretary of the treasury for international monetary affairs in the Nixon administration — a period that included Nixon’s decision to sever the link between the dollar and gold, thereby destroying the Bretton Woods system of fixed exchange rates. Paul may not have liked that decision, by the way; he favored exchange-rate stability. But he was the quintessential “good soldier,” always serving his country.

In between those two posts he spent a year teaching at the Woodrow Wilson School, which is when I first got to know him. He returned to the school for a second stint in 1988. What a bonanza for Princeton students!

Paul’s public service by no means ended when his U.S. government service did in 1987. In 1996, he chaired the Independent Committee of Eminent Persons to look into the dormant Swiss bank accounts of Jewish Holocaust victims. The committee recovered about $1.25 billion. In 2004–05, he chaired the Independent Inquiry Committee into the United Nations Oil-for-Food Program — a ticklish assignment because it involved Secretary General Kofi Annan’s son. In 2007, Paul chaired the Independent Panel Review of the World Bank’s Department of Institutional Integrity. Who, after all, had more integrity than Paul Volcker? The list is quick and incomplete, yet incredibly impressive. I could lengthen it easily, for Paul Volcker could not resist a good cause.

But he was also humble and down-to-earth, perhaps more at home with fishermen than with financiers. (He once quipped that the last useful financial innovation was the ATM.) It was a privilege to have known him.

Alan Blinder ’67, the Gordon S. Rentschler Memorial Professor of Economics and Public Affairs at Princeton, is a former vice chairman of the Federal Reserve System.

SEPT. 5, 1927 | DEC. 8, 2019

No responses yet