PAWcast: Rosa Wang *91 Is Empowering Women with Digital Finance

‘We would see a lot of women where it really changed their confidence … They became a leader within their community’

Listen on Apple Podcasts • Google Podcasts • Spotify • Soundcloud

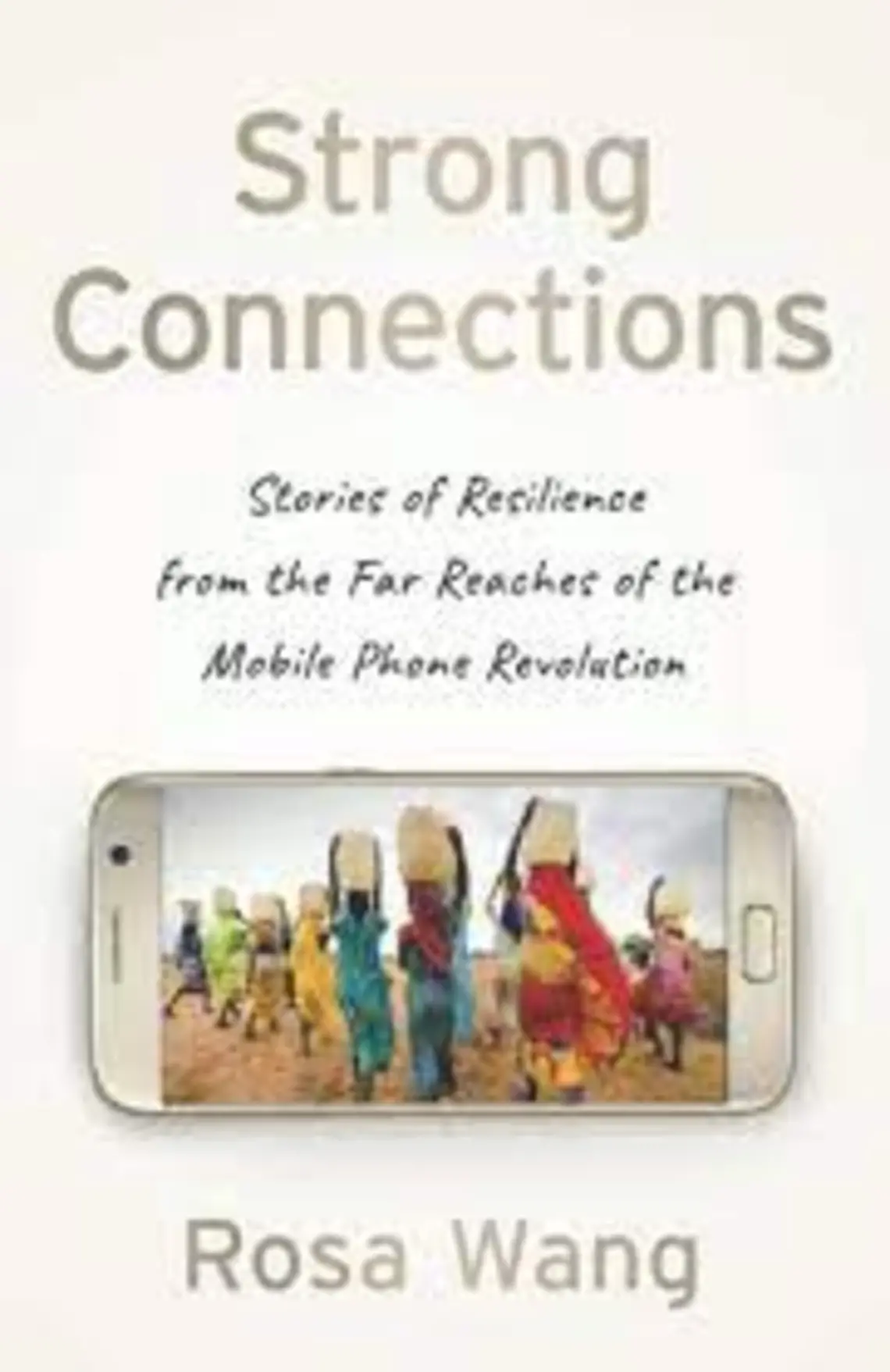

That little cellphone in your pocket can do more than you think. On the latest PAWcast, Rosa Wang *91 describes her work bringing mobile banking and digital financial services to some of the world’s poorest and most remote places. Using her background in investment banking, she found that cellphones have incredible potential for empowering women. In her new book, titled Strong Connections, Stories of Resilience from the Far Reaches of the Mobile Phone Revolution, she says the technology might even have the power to break the cycle of intergenerational poverty.

TRANSCRIPT:

Liz Daugherty: That little cellphone in your pocket can do more than you think. Rosa Wang works with Opportunity International, to bring mobile banking and digital financial services to place as remote as a tomato farm in Malawi or an open-air market in Ghana. She’s found that the ability to use cellphones for banking and to transfer money digitally has incredible potential for empowering women in particular to save money, grow their small businesses, and send their children to school. In her new book, titled Strong Connections, Stories of Resilience from the Far Reaches of the Mobile Phone Revolution, she says it might even have the power to break the cycle of intergenerational poverty in some of the poorest and most rural places on earth.

Rosa, thank you so much for speaking with me today.

Rosa Wang: Good to be here.

LD: So what made you want to write this book?

RW: So it was interesting. About five years before I started writing the book in earnest, I changed the way in which I communicated at conferences or workshops, at industry sort of events, so that instead of a more technical presentation, what I started to do was to weave stories, stories about the real people that I have met when I was on the ground and doing the field work. What I discovered was that people would connect with these stories. So I would often have someone come up to me, and they would be able to recite the entire story back to me, or they would be able to talk about their own work in quite a lot of detail. So I found that this had a real way to connect with people, and that they really seemed to immerse themselves, and it really seemed to be a way in which they could relate to people who live in circumstances very different from ours.

What I also thought was that, for the people that are working in the field, that often we tend to work in sort of an isolated space, and that there’s much about what we were doing that the rest of the world would be very interested in, but really didn’t have sort of a window to look at. So that’s what I really wanted to capture with the book.

LD: So let’s back up for a moment and talk about how you came to this work, which you’ve been doing for about two decades, I think. You actually switched careers from investment banking — so can you tell us how that switch came about?

RW: It’s quite interesting, because I would say a lot of things in my life have been — weren’t necessarily planned. So I had been working in investment banking, in portfolio management, in financial capitals like New York and Hong Kong. It was a really interesting and exciting place, and sort of very much in terms of contemporary things, so you’re always responding to current news, you’re always having quite an adrenaline-filled sort of thing.

But some point in about 2002, I decided that I wanted to maybe step away from investment banking a bit, because that’s when there were a lot of interesting threads that were being woven, where people were becoming more interested in things like environmental issues. There became much more of an awareness of how to — I think the use of the internet was still in relatively early phases, but how the use of the internet and digital information could start becoming transformative.

So I started to explore. I did a round-the-world trip after I left investment banking. And basically, within the first week after finishing my round-the-world trip, I was called by a friend, who said, “Do you know about social entrepreneurship?” I had to admit I didn’t know very much about it, but I was quite interested. She introduced me to some of the leading social entrepreneurs through the organization Ashoka, and through that I started learning by observing work of the Ashoka fellows how they were using market-based systems, how they were using business models, but to address some deep social issues and deep social problems, such as the lack of literacy, or such as maternal health, and yet they were doing so in really creative, innovative ways. And that’s when I became quite committed to the work of the social entrepreneurs and found that to be just an incredibly interesting and quite dynamic space.

LD: You know, as I was reading your book, I was realizing the power of mobile phones in a way that I think you might have also when you first came to it. Mobile phones for us are — you know, I mean, they’re such a huge part of our lives, but they can do so much for people in places that we wouldn’t have expected. Can you tell me a little bit about how, and you’re talking about social entrepreneurship, how does mobile technology kind of factor into that? What were you finding in these countries?

RW: Well, it’s interesting, because this is what I discovered by going there and actually seeing it. Part of it, I think, there is a bit of skepticism. You know, we’re talking about a sophisticated electronic device, but we’re talking about going into areas where people do not have electricity in their homes, and many of these people also do not have things like running water. So I think there’s a bit of skepticism about how could a phone make such a difference in a place like that?

What I discovered was that, in fact, because there was this lack of services, that the phone took on a role of sort of substituting or creating new ways of doing things. So instead of transport, which is very difficult because many of the roads are not paved, you know, some parts, in remote parts of the world, you’re going by canoe for hours and hours in order to get to the larger village. But instead of taking the very costly and very time-consuming transport, then people would be able to pick up a phone and call someone. We saw that a lot of the use came early on with shopkeepers, and people who have to deal with inventory. So they need to know, you know, how much do I purchase, because I’m going to make the costly trip to town, which they might do once or twice a month, and then, what is it that I need to pick up? And the phone became quite an important way in which they could call the suppliers and say, “OK, have this ready for me so that when I arrive I can maximize my time in town.”

But what I discovered was, there wasn’t really a limit. It was really, once you had the creativity applied to it and people started having phones in their hands, it started to permeate all kinds of areas. So I mentioned maternal health, because that was one of the ones that captivated me quite early on. So they would have messages, just simple text messages that might go to a pregnant woman that might say something like, “It’s the beginning of your second trimester. Please go and see the midwife,” or, “Reminder, you should take your supplements today,” things like that. So we started seeing it being used in very creative ways. And as I said, I think because many of the other services were not really available, many people turned to their phones as a way in which they began to create some of these new areas and new services. So really, it was a very — it’s a very dynamic place where creativity is applied.

LD: I was struck by some of the images that you painted in your book. I think the word I’m looking for is “ingenuity.” It really surprised me. It sounded like it surprised you as well, when you first started seeing it and discovering it and going into these places.

RW: You know, that was some of what I was trying to describe in the book. When you see something, and, you know, like you said, maybe like a very traditional village where there’s a lack of electricity in a lot of places, a lack of other good services, and then suddenly someone pulls out a phone. And it’s not just any kind of phone, but a brand-new rather sleek phone.

I describe in one of the chapters when I’m in rural Tanzania, in a place called Morogoro, so this is about five hours inland from the capital of Dar es Salaam, and that’s when I encountered the first triband phone. So this is where you can have three SIM cards that reside in it at once, because at the time, in Tanzania, and in many other places, they didn’t have the cooperation among the networks, but you had a lot of competition for services. So oftentimes you’ll find someone to purchase a relatively low-cost SIM card, but they would purchase it from each of the three service providers, and they would just rotate and see who’s giving the more attractive sort of promotion, or the more attractive deal right now; that’s the service I’m going to temporarily use, and they’ll notify people that, oh, I’ve got two numbers, or three numbers, or something. But it was that sort of juxtaposition of a very sleek, new device, including more sophisticated than what I was seeing in the US and UK, yet it was in this rural sort of farm village in Tanzania.

And that’s when I realized that there’s something about the phone and the decisions that people are making that’s perhaps even underestimated, and that when you have someone again that, where there are very few services, and the phone can make such a difference, the investment that they will put into it, and the savings that they’ll set aside in order to get a very high-end phone, that can be very, very substantial. And I think that was part of the underestimation, that even a lot of the mobile providers in their early days, when they would forecast what is the size of this market, or how many customers do we expect to have, you know, in the next five years, they almost always under-counted, very significantly. Part of it was, I think that they did not think that people living in very low-income areas would put aside a lot of savings and would prioritize the investment in a phone the way in which they did.

LD: Can you tell us about some of the ways in which you’re seeing cellphones transform these women’s lives? I mean, that’s basically asking you to sum up the whole book. But can you tell us about maybe one or two of the striking examples that kind of drove this home for you?

RW: So among the things that I found really interesting, one was that you would find that women felt that the ability to use the phone, one is, it would increase their sort of economic circumstance. I was obviously working in an organization which offers microfinance loans. These are small-scale loans, primarily to women, where the small group of women would co-guarantee each other. So this substitutes, because they might not have collateral or anything that a financial institution would consider collateral, so that they could be lent to. But then they would give them small-scale business loans so that they could buy inventory, or maybe expand their business, but use that in order to create much greater streams of income.

And what I continued to hear as I would meet these women and ask them, “How have things changed for you?” They would talk about one is, of course, that they were economically better off. And among things they would always mention were things like, “I’m now able to send my children to school.” So in many places, even if the government is paying for the education, they would have to buy uniforms, they would have to buy books and supplies. So without some form of cash income, the children might have to drop out of school. So having digital access in a way in which they can boost their business really did help the whole family. And I talk about breaking the cycle of poverty, so you really want to break that intergenerational poverty, that the next generation would have education.

But another thing that I was really struck by was how many women said, “Our husbands treat us better because we are now contributing financially.” I think this is the kind of individual autonomy that you want to see: The sort of empowerment within a household, that the status of the woman, despite the sort of historical, patriarchal ties and other things that many of these women would covey that, inside their own household, that their husband would respect them more, they would be more involved with financial decisions for the whole family. They were treated as someone who was financial literate and could contribute.

We would see a lot of women where it really changed their confidence level, and they became a leader within their community. So they would help the other women learn how to use their phones. They might become, say, a leader in their church group, or other community kinds of things, but really change the confidence level, so they would stand up and be a leader. And I think that just underpins how much of an empowering role, and how, like you said, in a place like I now live in the U.K., but in places like in the U.S. or in Europe, most people are sort of accustomed to the phone, and they are almost a bit cynical about it, and I think undervalue that for someone like a poor woman, let’s say, in rural India it can make a great deal of difference to her confidence and to her level of empowerment.

LD: It seemed that the combination of bank accounts that could be accessed by cellphones also seemed to give them more control over their money. You had women who had their own bank account, accessed through — I thought this was fascinating, they can’t read or write — a biometric scanner, right, where they scan their eyes or scan their fingerprints, so it really belongs to them, right?

RW: This, I think, was one of the most powerful things that I saw, particularly in some of the more challenging places to work in India. So in India, the government there has undertaken a whole series of measures to try to improve the sort of what they call “financial inclusion,” but giving formal financial services. But despite having some Herculean measures, including introducing a comprehensive identification program, collecting the biometrics, the Aadhaar program, what one of the things I think they underestimated was that still, many of the people most in need of this don’t have the literacy, and so you need to have sort of an assisted environment in which they can receive these services.

But the point that you make about then it’s in the name of the woman, this is quite important, because what had happened before, and by “before” I mean less than a decade ago, if state government or someone was paying welfare benefits or rural subsidy, as they do in many states of India, to an area, they used to give the chieftain sacks of cash, and then the chieftain would sort of then distribute the sacks of cash. And because these are often patriarchal areas, oftentimes it would go, say, to the husband or to the man of the house, and he would make the decisions about what’s to be done with the money.

But now with the accounts and with the biometric, this means that a woman, even though she can’t read, she can present, say, her thumb print, place it on a thumb print reader, it accesses her record instantaneously. If she has some money, then she can give it to an agent who is a person to sort of assist the woman, and she can accumulate the funds in her own name. This means that she’s the only one that can withdraw it. So if her husband wanted to take all the money and sort of run away with it, he does not have access, because he can’t access her biometric account. So the ability of safeguarding the funds for the woman, and the ability for her to receive the things she’s entitled to, such as these government payments, those have all been enabled by the combination.

I don’t want to say it’s any one thing, it’s the combination of all of these things — it’s the biometrical readers, it’s a series of agents, it’s the mobile signal that’s required to make all of these take place. And it is the comprehensive identification system of Aadhaar that’s been put in place. But all of those things have come together that really then enables the woman to have access to that which is rightfully hers.

LD: I think one place where you talked in your book — and I really want to talk about this — where all of those factors kind of came together, so make me go, whoa! I see why this is working — in India, right? They had a couple of small bills that were used very frequently by people in poverty in rural areas in this cash-based system, and the government just got rid of those, and said we’re not going to use those bills anymore. And overnight, they became worthless. So these families, the women who had these small bills kind of squirrelled away, basically hidden in coffee cans around their homes, suddenly all of that was worthless. And all I could think was, if only they had been putting it all into an electronic bank account. Right?

RW: Yeah.

LD: That really drove it home for me.

RW: Yeah. Yeah, and that was quite an emotional sort of thing for me to write out, the scene where I’m sitting on the floor with the women, because it really was the sequence where I’m there visiting — this is in Bhopal in India — I’m invited to sit on the floor with the women, because I’m there with the head of this group, called Samhita, and she is also a woman — she asks the male staff to exit, and so the women would answer quite candidly in a way that if the male staff had remained, they probably wouldn’t have.

And we started to ask the women, you know, what do you do with your savings? And they would talk about, “Oh, I hide it. I hide it in the garden, I hide it in these cans, these canisters, and put it in places sometimes I forget.” And it was all quite light and humorous, it was one of the few times that people were laughing. Then I left Bhopal. And it was exactly just a couple of days later that the government announced the demonetization. And no one had received warning. Certainly these women didn’t, but all of the microfinance organizations that I was partnering with and working with on the ground in India, they did not have any warning. And the major banks did not have warning.

So you started seeing in the news, just these massive lines of people who were desperate to try to deposit their cash into a formal account, or into some form of electronic money before it would become worthless. And the government said dozens of people died just standing in lines, and many people on the ground said that’s an undercount. But it really was because those things happened in such close sequence, it really had a huge emotional impact in terms of my thinking and my sort of appreciation of the vulnerability that these women were under, because they hadn’t put the money away formally, because they were just — you know.

This would be, for example, the equivalent of the $10 bill and the $20 bill — what happens if those went away. And that’s what they were secretly sort of saving up, trying to save for something. And that was just all erased. It was very much the sense, then, that OK, not only do we have the elements that are possible to try to bring some of these benefits to these women, but it’s now absolutely essential because it’s really — you know, we now see the downside of what happens if they’re not protected, what happens if they don’t access the formal services.

LD: So what’s changed over 20 years working in this field? What have you seen change? And where does it go from here? What more needs to be done?

RW: So the thing that really struck me, when I was writing particularly some of the statistical parts of the book, or referring to certain statistics, was just how rapid the pace of change was in all of this time. So during the last two decades. And I was reflecting on this, because, of course, when I was a graduate student at Princeton, I finished my degree in 1991, and all of the events, and basically the mass proliferation of phones all over the world and the change in which everyone’s day-to-day activities have changed because of these phones, that’s all taken place just post-graduation, in that period. So the rapid pace of change just really struck me as I was pulling the scenes together and sort of filling in some of the backstory of what was going on, in terms of what was going on in the industry and what was going on as the expansion of phones was taking place.

I think we’re going to continue to see, obviously not this pace because we have quite widespread use of phones now, but I think we’ll continue to see more and more services added onto these, and we’ll see combinations of services. So I think we’ll see things like greater use of biometrics. So for example, in refugee communities where a person does not have strict documents, the biometric way of access and the biometric way of identification seems to have a lot of advantages.

I think we’ll also see more customization, so people are starting to recognize, OK, in addition to, say, English, or English and maybe the main language of Swahili, we can now offer services using things like voice, so it can be recorded in all of these minority dialects, or smaller dialects in a lot of countries. So I think that will result in more personalization.

One of the things I just sort of didn’t have enough time to delve into a huge amount was that this, of course, introduces some risks. I don’t want to be naïve to the fact that when you have a powerful technology tool, it will have consequences, both positive and negative. And I think there are concerns about things like customer protection; what happens if you have an unsavory person trying to take advantage of a less educated person? Things like data protection, you know, who owns the data, who has access to it? Some of the questions that we encountered were, can you adequately train someone, do they fully appreciate what it means when you try to train a person about, you need to really protect, say, your PIN code and your access code to your phone, because they are living in very low-income circumstances. And I think what we’re seeing is, of course, that then puts them at greater risk.

But I think we will see all of these things kind of interacting and being part of the fabric where people need to have an open discussion in these developing areas — what are the positive and negative consequences, and what happens to communities as you introduce more and more ways for people to interact digitally, and more ways for the pace of change really to accelerate?

LD: Sure. I can see that really opening the door for the need for more education around data literacy, and some other things like that; training and better understanding regulations and safeguards and all of those other things that go along with a digital revolution, just like we’ve seen here in the states and in a lot of other places.

RW: Yeah, I’m expecting to see a lot more. One of the things that I would like to see happen in the book, where I look at sort of the history, the recent history, of the early days of the mobile phone — one of the things that was striking to me was the importance of standards. And it’s interesting, because this is something very, very few people have asked me about. People have asked a lot more sort of personal questions that have come out of the book, but very few people have sort of talked about the standards.

And it was very interesting that basically, there had been agreement among different countries and different bodies to agree to a set of standards, so basically the devices that one manufacturer would make would be able to talk to another manufacturer, would be compatible with the masts that were there, and all of the other infrastructure. And I think that’s something in this sort of close-knit collaboration of independent parties that, I think, gives a roadmap for ways in which things can become highly scalable, and ways in which entrepreneurs can think about introducing things quite widely, is through that. So I think that the early history of the mobile phone embeds a lot of very interesting things that I think will be part of the discussion for years to come.

LD: You know, that gets through a lot of my questions. Is there anything else you’d like to add? Or anything else you’d like to mention or talk about?

RW: So one of the things that I thought was also really interesting was in the way in which the mobile phone is sort of closing the information gap to rural areas. So when I first joined Opportunity International, that was largely working in conjunction with the agriculture program, because we were trying to reach more remote, rural communities, which are really the farming communities. So to the extent that agriculture in developing areas is such a major part of these developing economies, and so many people are engaged in agriculture as their labor and as their way of earning income, I see that as becoming a really important part of the discussion of kind of how to develop rural economies more, and how to sort of close that rural-urban income gap.

Then it lends itself, I think, also to the natural extension, because agriculture, particularly in Africa, is where we’re seeing some of the most acute signs of climate change. So you’re seeing drought, a lot of people trying to turn more to things like climate-smart agriculture. But I think all of these key issues are intertwined. And when working in areas like economic development, you can’t just sort of segment one thing to the exclusion of another, but I think ultimately, they’re all sort of intertwined. But I think digital has a key role to play in some of the big challenges that everyone is seeing before us.

LD: This is really interesting, I could talk for a really long time, but I think we might be out of time. So I’m going to say thank you so much for taking the time to talk to me about all of this.

RW: Thank you. It’s been good to be here.

PAWcast is a monthly interview podcast produced by the Princeton Alumni Weekly. If you enjoyed this episode, please subscribe. You can find us on Apple Podcasts, Google Podcasts, Spotify, and Soundcloud. You can read transcripts of every episode on our website, paw.princeton.edu. Music for this podcast is licensed from Universal Production Music.

Paw in print

February 2026

Lives Lived & Lost in 2025, Saying ’yes’ to more housing; AI startup stars

No responses yet