America’s Investment in Higher Education

As this issue of the PAW was going to press, we learned the sad news that William G. Bowen *58, Princeton’s 17th president, had passed away. Bill’s vision helped to shape not only the Princeton we know and love today, but also educational policy on a national scale. In his last book, discussed here, Bill’s matchless insight was again on vivid display. We are in Bill’s debt, and we will miss him.— C.L.E.

Access and affordability are signature values at Princeton University. Thanks to generous support from its alumni, Princeton is able to offer unsurpassed financial aid. Approximately 60 percent of the undergraduate student body receives aid, compared to 42 percent in 2001. The average scholarship for those on aid is $48,000, which exceeds the University’s $45,320 tuition price; for some students, financial aid covers all or a portion of room and board as well.

As a result, more than 80 percent of Princeton seniors graduate with no debt at all. The remainder, most of whom take out limited loans to cover discretionary purchases, graduate with a median debt in the range of $5,000 to $6,000.

The national picture is very different. According to the Institute for College Access and Success, in 2014 69 percent of seniors at America’s four-year public and private nonprofit universities graduated with debt that averaged nearly $29,000. Rising debt levels and tight job markets have sparked widespread concern about whether college education has become too expensive.

The debate about how to pay for college is important, but it is filled with myths and misunderstandings. News stories, for example, often focus public attention on highly atypical students who rack up staggering debts. One recent analysis found that the average borrower in such articles owed $85,000. As economists Beth Akers and Matt Chingos point out, less than 1 percent of four-year degree holders have that much debt. [1]

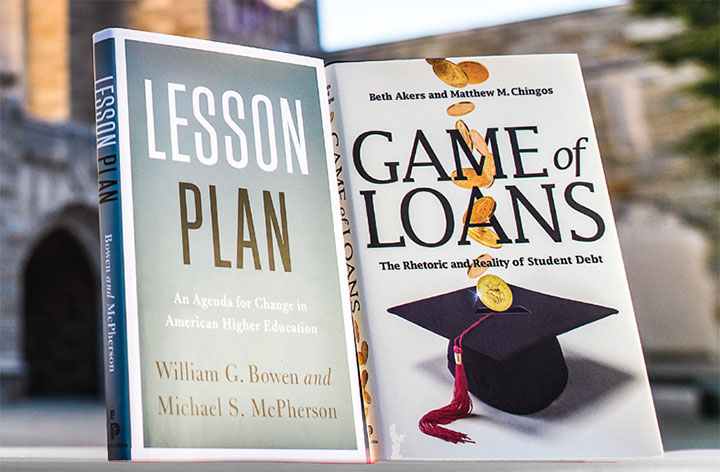

Akers and Chingos make that observation in Game of Loans: The Rhetoric and Reality of Student Debt, one of two new Princeton University Press books that offer insightful guidance for higher education policy. The other, by Princeton’s 17th president, William G. Bowen *58, and his co-author Michael McPherson, is Lesson Plan: An Agenda for Change in American Higher Education.

Game of Loans and Lesson Plan share a commitment to data-driven analysis. They also share a fundamental premise: from an economic perspective, education is an investment, and it should be judged not by its price but by its net return. (The authors recognize and reaffirm that a college education also has tremendous non-economic value.)

As Bowen and McPherson note, the returns to a college education are spectacular and continue to rise: Christopher Avery and Sarah Turner estimate that “the economic return to a college degree tripled for women between 1965 and 2009 and rose nearly as fast for men.” [2]

Unfortunately, media reports bury this point, and public views about the value of a college degree are often shockingly inaccurate. Last spring, for example, The New York Times and Google asked Americans to estimate “the unemployment rate for 25-to-34-year-olds who graduated from a four-year college.” Interviewees were told that the unemployment rate for those with only a high school degree was 7.4 percent.

Most respondents guessed that the unemployment rate was higher for college graduates — the average answer was 9.2 percent. In fact, a college degree dramatically improves job prospects. Only 2.4 percent of 25-to-34-year-olds with a fouryear degree were unemployed. [3]

The economic returns to education are, of course, long-term, whereas the costs are paid up front. Families are justifiably concerned about how to cover these costs. We must decide, as a society and as individuals, how much we want to invest today in exchange for future benefits, how to finance that investment, and how to make the investment as efficient as possible. Those questions are the focus of Game of Loans and Lesson Plan.

Careful attention to the numbers leads the authors to insights that should transform policy debates. For example, they show that the biggest problems in the student loan system come not in its upper reaches —where those $85,000 borrowers reside — but at the spectrum’s lower end. Akers and Chingos note that students who drop out of college after one year accrue relatively little debt. However, the lack of a degree limits their job prospects, and they struggle to pay back even small loans. [4]

This point has major implications. It suggests that policymakers should focus far more attention on raising degree completion rates and counseling students about where to study and what loans to take. Ensuring that students actually get their degrees will do more good than many of the popular policy proposals that focus on, for example, reducing interest rates or tuition. Many institutions are making efforts to control costs in various areas, but additional investment makes good sense when it raises completion rates.

Investing in education is critical to America’s future. Doing so effectively and efficiently will depend on the kind of clear-eyed analysis offered in Game of Loans and Lesson Plan. Princetonians, who have demonstrated a deep commitment to education and financial aid, can play an important role by participating vigorously in the public debates that these books will generate.

1. Akers and Chingos, pp. 18–19.

2. Bowen and MacPherson, p. 5.

3. The New York Times, http://nyti.ms/2eatvKQ

4. Akers and Chingos, p. 30.

1 Response

Norman Ravitch *62

8 Years AgoIf universities set their...

If universities set their tuitions and fees at reasonable rates (this has long since been gone), there would be no need for student loans or financial aid. Admission should be entirely based on ability and fees should be reasonable and even modified for those with financial disabilities. Universities in this regard are not being ethical. The student loan process has only given universities free rein to charge whatever they wish, for administrators to be grossly overpaid for the little good they do, and for faculty also in many cases to be grossly overpaid and over-privileged.