Edward J. Balleisen ’87 Conducts an Audit on American Fraud

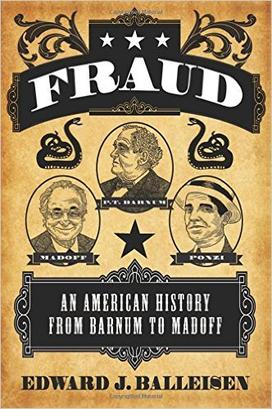

In Fraud: An American History from Barnum to Madoff (Princeton University Press), Edward J. Balleisen ’87 traces the history of fraud in America from P.T. Barnum to Charles Ponzi and Bernie Madoff. This book describes modern regulatory institutions’ slow, incremental attempts to protect consumers and investors, throughout the Gilded Age, the New Deal, and the Great Society. The book concludes with the recent era of deregulation, which has brought its own share of vast and widespread frauds, including the recent mortgage-marketing debacle, and reminds us that American capitalism rests on an uneasy foundation of social trust.

The author: Edward J. Balliesen is associate professor of history and public policy and vice provost for interdisciplinary studies at Duke University. He is also the author of Navigating Failure: Bankruptcy and Commercial Society in Antebellum America (University of North Carolina Press).

Opening paragraphs: “In the late fall of 1984, an up-and-coming Midwesterner gained a sharp lesson about the growing reach of the United Stated government. For eight years, this former railroad station manager had nurtured a succession of mail-order businesses in Chicago and then Minneapolis. Through experiments with national print advertising and wholesale catalog distribution, he discovered an instinctive knack for mail-order marketing. Cultivating a folksy style, he combined alluring descriptions of goods, aggressive expansion, sharp discounts, and all manner of promotional hullabaloo. Within a few years, he gained endorsements from leading banks and public officials across the Midwest. … Then, just two weeks before Christmas, the United States Post Office threatened this mercantile impresario with the equivalent of a commercial death sentence. On December 11, the postmaster general issued a fraud order against his firm. The recipient of this administrative notice was Richard W. Sears, the creator of the “Dream Books” that came to rest on hundreds of thousands of kitchen tables across rural America, the driving force behind Sears, Roebuck & Co, in its first two decades. … As we shall see (and as Sears, Roebuck’s extraordinary growth in the decades after December 1894 would suggest), Richard Sears found a way to make the fraud order go away. But his encounter with postal regulators reflected several interrelated problems that U.S. businesses, policymakers, and citizens have confronted since the advent of modern capitalism — how should Americans define fraud, how much should they worry about it, and how should they structure institutional responses to it?”

Reviews: Dean Jobb from Chicago Review of Books calls it “an ambitious exploration of two centuries' worth of swindles, bogus stock schemes and corporate crime. [Balleisen's] keen insights and the breadth of his knowledge keep the reader engaged, and he introduces plenty of shady characters and ingenious fraudulent schemes to boot."

No responses yet