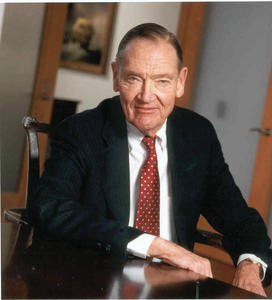

Forum in New York honors Bogle '51

The story John C. Bogle ’51 often tells of his senior-thesis journey is something to which nearly every Princeton senior, past and present, can relate. It started in Firestone Library and ended before graduation in a 133-page document.

Holed up in then-newly built Firestone Library, Bogle paged through a December 1949 copy of Fortune magazine looking for inspiration. An article on page 116 caught his eye. It was titled “Big Money in Boston,” and it discussed the “tiny but contentious” mutual-fund industry. Bogle realized he had found his thesis topic as he read about an industry that appeared “totally untouched by academics and the press” at the time.

Bogle’s thesis, titled “The Economic Role of the Investment Company,” outlined a strategy to make investing in mutual funds more accessible to individual investors with lower costs made possible through indexing rather than actively managing funds.

The idea eventually led to Bogle’s founding of the Vanguard Group in 1974, an investment-management company that took advantage of low-cost indexing. Vanguard now manages approximately $1.6 trillion dollars in assets, according to a February 2011 estimate.

At a Jan. 31 gathering that celebrated Bogle’s influence on the financial world, former Federal Reserve chairman Paul Volcker ’49 said, “[Bogle] is still living off an undergraduate thesis he wrote at Princeton. He got the thing reprinted! And it sells 50 years later!”

Bogle replied, “Never underestimate the power of luck.”

When asked by a moderator if there was a secret Bogle and Volcker could share about their respective successes, the two laughed. Bogle answered, “Yes, go to Princeton!”

The invitation-only John C. Bogle Legacy Forum was held on Wall Street in the grand ballroom of the Museum of American Finance, a building at the address of Alexander Hamilton’s first offices for the Bank of New York. The forum attracted hundreds of guests, including individual investors, financial analysts, top financial journalists, and others interested in Bogle’s ideas. Several distinguished panelists, including Princeton professor Burton Malkiel *64, spoke throughout the day, weighing in on Bogle’s legacy and outlooks for the financial future.

Malkiel spoke on the viability of the indexing model championed by Bogle and highlighted the remarkable success of Bogle’s “revolutionary contribution” given that it grew out of his Princeton independent work. Malkiel, a former board member at Vanguard, said he wasn’t disappointed that only about a third of money is indexed rather than actively managed, as he expects the popularity of indexing will continue to grow over time. “If you think of an idea that started in the academy and was so difficult to get started has had that much traction,” he said, “I don’t see the glass as half empty or two-thirds empty — I see it as one-third full.”

Professor Alan Blinder ’67 moderated a discussion on corporate governance and controversial executive compensation, asking his panelists for realistic remedies to these issues that many believe to be contributors to the 2008 financial crisis.

The highlight of the day was an afternoon conversation between Volcker and Bogle, who discussed the “vanishing” confidence investors have in active managers of mutual funds as well as the role indexing might play in the future for restoring investor confidence.

Volcker insisted that this broken confidence extends to the government, citing polls that show less than 20 percent of people trust that the “government will do the right thing most of the time.”

Bogle’s solution to restore this confidence in government, like his strategy with Vanguard, requires giving power to individuals through information.

“You just have to have an informed electorate, even as you have to have an informed investor base,” Bogle said. “Give investors the right instructions about how the markets work and focus on the long-term, have them focused on low-cost. … The same principles are really true of government.”

Emily Trost ’13 is a geosciences major from Huntingdon Valley, Pa.

No responses yet