Portrait of a Takeover Artist: Controversial Corporate Raider Carl C. Icahn ’57

The investor says he wants to own and actually run the nation's fourth-largest airline

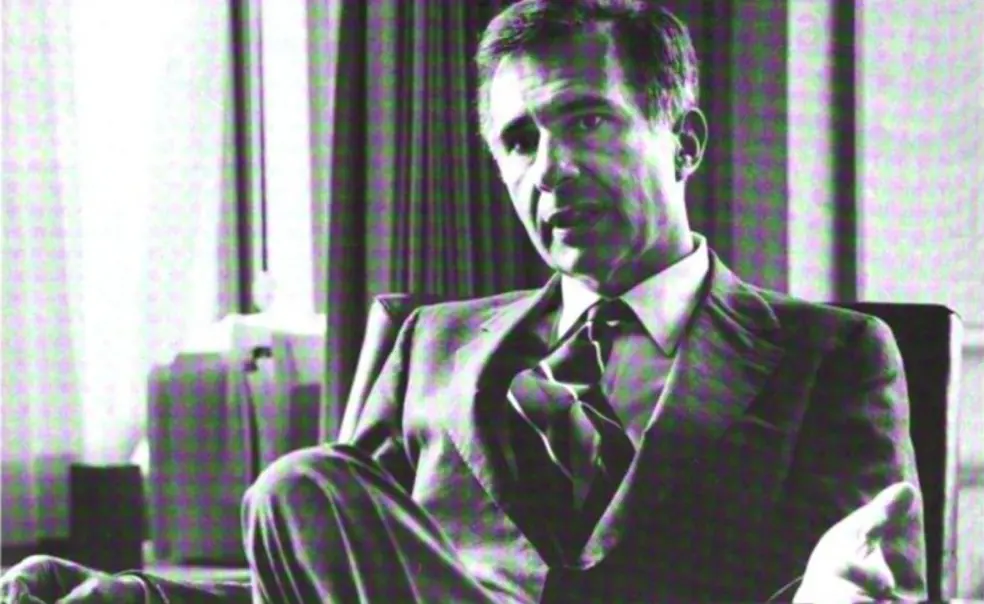

Carl C. Icahn ’57 – arguably the most admired, feared, respected, and disparaged investor on Wall Street – had made a crucial move in his bid for control of Trans World Airways, and he seemed fatigued. It was mid-afternoon last August 6. Icahn’s lean, six-foot-three-inch figure shifted restlessly as he sat behind the desk, littered with pink “While You Were Out” memos, in his 27th-floor office at 56th Street and the Avenue of the Americas. Through the plate-glass windows, the vast expanse of Central Park filled the background. His tie, pulled loose at an unbuttoned collar, hung awry. He rubbed his right temple as if to ease a headache. “I’m kind of busy,” he said. “I guess you’ve been reading about this TWA thing.”

Indeed. Since May, when Wall Street analysts traced the sudden increase in trading of TWA common stock to a furtive buying spree by Icahn, his takeover attempt had been engulfed in controversy. THe airline brought suits against him in both state and federal courts, claiming that he intended to “loot TWA” by liquidating assets and firing employees, leave the carrier in a state of financial ruin, and then “move on to the next victim.” While he was sparring with TWA’s lawyers, the company’s board of directors made another effort to repel his foray: it tentatively agreed to be acquired for $23 a share o $925 million, by Texas Air, which runs Continental Airlines and New York Air. The financial community expected Icahn and his group of investors to cash in on their holdings – a hefty 32 percent of all TWA stock, bought at an average price of $16 a share – for a net profit (after subtracting $21 million for legal fees, interest, and other expenses) of about $57 million. Icahn alone stood to make an estimated $45 million. But he vigorously continued his raid, claiming a desire to own and actually run the nation’s fourth-largest airline.

He found a useful ally in TWA’s unions, which were highly fearful of Texas Air president and chief executive officer Frank Lorenzo. An aggressive, Harvard-educated lawyer Lorenzo had a reputation for union-bashing. At Continental, he had used Chapter 11 bankruptcy proceedings to impose deep wage cuts and cancel labor contracts. In a marathon 28-hour session that ended at 12:30pm on August 5, Icahn forged an agreement with representatives of TWA’s pilots and machinists. THey consented to work-rule changes and sharp salary cuts that could save the airline over $300 million a year and return it to profitability. In exchange, both unions would received 20 percent of TWA’s common stock and a 20-percent share in the company’s profits.

It was a coup for Icahn, and, in retrospect, it was clearly the turning point in the TWA saga. To be sure, the following months held many further obstacles and complications. But the union alliance, along with his massive holdings of TWA stock – he would soon increase his share to over 50 percent – effectively won him control of the airline.

TWA is the boldest and most intriguing of Icahn’s raids, more than a dozen campaigns since 1979 that helped to create a national controversy. Heated debates over the impact of hostile takeovers fill the popular press, the scholarly journals, and the halls of Congress. Wall Street cognoscenti argue the ethics of “junk bonds” – the low-rated, high-risk, high-yield debt securities issued by phantom corporations. Pioneered by Drexel Burnham Lambert Inc., these bonds helped multi-bilion-dollar takeovers by Icahn and others. Last month, the Federal Reserve partially resolved the issue by placing restrictive requirements on the use of junk bonds. Wall Streeters, though perturbed, remained confident that they are creative enough to devise whatever new financial “instruments” are necessary to keep the game sizzling hot.

Takeover jargon abounds with militaristic imagery – “scorched-earth defense,” “poison pills,” “shark repellents,” “golden parachutes.” On Main Street, corporate raiders are the new American pop heroes and villains. T.Boone Pickens Jr., chairman of Mesa Limited Partnership, receives fan mail from stockholders urging him to acquire their companies. A cover story in Time magazine compared him to television’s infamous J.R. Ewing and fancied Pickens as a modern-day David doing battle with the Goliaths of Big Oil.

The full-blown hype, the verbal mudslinging, and the dramatic duels between allegedly evil “raiders” (like Icahn) and “white knights” (like Texas Air) have led a number of financial journalists to compare the scene to another great 1980s American pastime, professional wrestling. T.Boone Pickens and Carl Icahn, are, respectively, the “Mr.T and Hulk Hogan of takeovers,” quipped Fortune Magazine. The comparison has an obvious flaw. In pro wrestling, everyone can tell the good guys from the bad guys. The aforementioned Mr.Hogan, for example, is universally hailed as “the defender of the American Way.”

In corporate takeovers, however, there’s discord over whom to root for. The raiders call themselves crusaders for the rights of oppressed stockholders against inept, entrenched managements – and many economists concur. Other experts see the raiders as a source of chronic instability in the US economy. Executives and lawyers of corporations preyed upon by Icahn have called him “manipulative and deceptive,” a “notorious corporate opportunist,” and “one of the greediest men in America.” On the other hand, two chief executives who had waged corporate combat with Icahn later became investors in the limited partnership he uses to bankroll his raids.

Icahn’s reputation as an energetic fighter is well-deserved. But last August, he had a decidedly pessimistic outlook on the prospects for future takeovers. His tone was downbeat, embattled. “It’s a tough game. There are a lot of times when they’re writing bad things about you and all, so the guy with the big money says “Hey, who needs it?”

Icahn has the big money, but he evidently still needs the thrill of the strategic positioning and the competition enough to dismiss the negative press and hostile counterattacks. “I’ve been through it,” he said. “I’m a seasoned warrior already, so I don’t mind it so much.” But the roster of powerhouse takeover artists is short. Even Pickens suffered as estimated pre-tax loss of $100 million – and a loss of prestige – when he failed in a bid for Unocal last year. “Look, they’re hurting,” Icahn said. “Pickens went through a lot with Unocal, so there aren’t too many guys who really do the big ones. There aren’t many. [Sir James] Goldsmith is one. [Irwin] Jacobs, and myself. That’s about it. And I don’t know how many times PIckens is coming out any more. If they come up with more legislation, there will be nobody. And that’s really bad for our society.”

Icahn grew up in Bayswater, Queens. His father was a lawyer and sometime synagogue cantor with a passion for books and classical music; his mother is a former schoolteacher. He was the first student from Far Rockaway High School to gain admission to Princeton. Classmates recall that he had a sharp, analytical mind and was an expert chess player. He concentrated in philosophy and his 80-page senior thesis, “The Problem of Formulatng an Adequate Explication of the Empiricist Criterion of Meaning,” won an award. Its arguments are complex, carefully constructed, and esoteric.

“The criterion as it stands explicated is the rather vague notion that a sentence in order to be meaningful must be able to predict or in some way be related to experiential events,” he wrote in the preface. Occasionally, he enlivened the philosophical arguments with a light-hearted example: “The sentence ‘In my room, during this my senior year at Princeton, there are arranged a number of red and white beer cans on the mantelpiece’ is cognitively meaningful if and only if it can be translated into the conjunction of the following conditional sentences…”

Icahn thrived on the independence and single-minded concentration required of the thesis. “Twentieth-century philosophy is very analytical,” he said. “I like that kind of thinking. It trains your mind.”

Icahn was a member of Prospect Club, where he played intramural sports and served as librarian. He sold advertisements for the Daily Princetonian, and worked during the summers as a cabana boy and on construction jobs to help pay college costs. After graduation, he entered medical school at New York University. This decision surprised his roommate, Peter Liebert ‘57, who had expected him to pursue a more scholarly path, such as graduate study in philosophy or economics. (Liebert, a pediatric surgeon, has been a silent partner in several Icahn deals.)

Two years later Icahn dropped out of medical school, which he didn’t like, and enlisted in the Army. As a private stationed at Fort Sam Houston in San Antonio, he won several thousand dollars playing poker in the barracks. In 1961 he left the service and joined the New York brokerage house Dreyfus & Co. as a trainee stockbroker.

Meanwhile, he invested his poker winnings, quickly made $50,000 in a bull market then lost it when stock prices sank in 1962. Feeling that he needed a specialty, he became an options broker, at Tessel, Patrick & Co. in 1963, and then at Gruntal and Co. in 1964.

Options was a relatively new and unconventional field; trading information wasn’t publicly listed yet. Icahn developed a strong following of clients nationwide. In 1968 he paid $400,000 to acquire a seat on the New York Stock Exchange, borrowing the bulk of that from Elliot Schnall, an uncle and client, and launched his own firm, Icahn & Co. (Interviewed for the MacNeil-Lehrer Newshour, Schanll said “I was once the rich uncle. Now he’s the rich nephew.”) Icahn also ventured into another highly specialized business – arbitrage, the art of profiting from slight discrepancies in the prices of securities through complex maneuvers. And then came the takeovers.

Last December, Newsweek ran a photo of Icahn at his 38-acre estate in Westchester County, New York. He looks like the consummate suburban preppy, wearing chinos, a white windbreaker over a bright yellow polo shirt, and unlaced topsiders. He stands with his German shepherd in front of his palatial 20-room house, clenching a tennis ball in one hand. An avid tennis player, he maintains a court of the estate. He has been married for eight years – his wife, Liba, was born in Czechoslovakia – and has two children.

Icahn’s other real-estate holdings include the two properties adjoining the Westchester residence (to ensure privacy), a second home in Florida, and an apartment on Manhattan’s Park Avenue. He also has a corporate jet.

Though Icahn, now 50, retains an athletic frame, his dark hair is graying on the sides. His face is long and oval, with thick, dark eyebrows over penetrating eyes and a prominent nose. His intellectual and analytical bent is overshadowed by the persona of a street-smart fighter. He strings choppy sentences with an unmistakeably New York accent. But if his diction is unpolished, his style is direct, engaging, and forceful, reflecting the skills of a practiced negotiator. He interrupted our conversation to take a phone call, apparently from a friend who was seeking his backing in a takeover. The stakes were too low; Icahn refused. Later, another phone call. “Up 28 hours straight with those unions,” he answered. “They hate Lorenzo, they hate him.”

Icahn’s firm maintains a staff of about 50 people involved in discount brokerage and conventional securities trading. But Icahn masterminds the takeovers on his own. He pores over copies of annual reports and Securities and Exchange Commission filings of potential target companies and confers with only one advisor, Alfred Kingsly, a close associate for over 20 years.

The basic strategy has been the same from the start. Icahn identifies the target and, through a network of obscure corporations and partnerships, secretly buys an initial stake of five percent of the company’s total stock. After reaching that level, investors are required to submit formal disclosures of their holdings to the SEC within 10 days. During this brief period, Icahn furiously purchases more stock boosting his stake to 20 percent or more – while still maintaining the secretive cover. Rumors about his intentions could trigger a wave of speculation, inflating the stock price and thus making his bid costlier.

By the time the public learns that Icahn is on the prowl, he has already become one of the company’s major investors. He telephones the chief executive and asks for a seat on the board of directors. Later he might make a tender offer to purchase all outstanding shares of stock. This creates a threatening situation. An Icahn takeover would surely result in the ouster of top management. Typically, the company responds by bringing lawsuits against him, seeking a court order to block the hostile takeover attempt.

If the lawsuits fail, the company might try to foil Icahn’s designs by inviting a “white knight” to acquire it in a “friendly” takeover. A different option is the “leveraged buyout.” A small group of investors (usually the company’s executives) acquires the company in a transaction financed by heavy borrowing. Thus, a publicly held corporation is transformed into a private firm. The debt is ultimately paid off with profits from the company’s operations, or by the sale of assets. Another defense used by target companies is striking a deal to buy Icahn’s stock holdings, either at the prevailing market price, which in many cases has doubled since he began his raid, or at a premium.

The cover-pages of annual reports from each of his corporate targets hang in the reception room of Icahn & Co. Visually, the display isn’t particularly impressive: the wall is decorated with a nondescript burlap, and the covers are mounted in simple frames. Symbolically, however, it chronicles an awesome string of financial successes.

Baird & Warner, a Chicago-based real estate investment trust, was Icahn’s first target. He won control of the company in 1979 through a proxy battle, and renamed it (after his childhood neighborhood) the Bayswater Realty and Capital Corp. The next campaign, launched later that year, was Tappan Co., a manufacturer of ovens and stoves. He began buying Tappan stock at $8 a share, a highly depressed price. When he had acquired 5 percent, he demanded and won a seat on the board of directors. He pressed to gain control, and Richard Tappan, chairman of the company carrying his family name, sold it to a white knight, AB Electrolux of Sweden, for $18 a share. Icahn made a $2.7 million profit on an investment of $1.4 million.

Then came his 1982 raid on the Chicago-based Marshall Field and Co. Again he lost to a white knight – Marshall Field agreed to be acquired by Bachus Inc., a tobacco and retail concern – but he still made a $33 million profit on a six-month investment of $17 million. Later that year, he went after Dan River Inc., a textile company based in Danville, Virginia. After a bitter six-month battle, Dan River escaped his grasp by transforming itself into a private firm through a leveraged buyout. Icahn had started purchasing stock at $12 a share. and sold his holdings for $22.50 a share. He made an $8.5 million profit on a $14 million investment.

Icahn's raids began coming more fre-quently, and he continued to make eight-figure profits in campaigns that lasted only a few months. Gulf & Western Industries Inc., Saxon Industries, Simplicity Pattern Co., American Can Co., and Chese-brough-Pond's, Inc., each bought back Icahn's stock holdings to rid themselves of the threat of a takeover.

In June 1984, Icahn finally succeeded in purchasing a big company. ACF Industries, a manufacturer of railroad cars. The cost was about $420 million. As expected, he began to auction the company's undervalued assets. He sold three divisions for $360 million, retaining only the rail-car division, which has remained a competitive force in its market. He also closed the New York headquarters, firing most of its 180-person staff—apparently without hampering ACF's performance.

These early investment ventures were only a prelude to Icahn’s bid last year for Phillips Petroleum Co., his first multi-billion dollar target. Actually, the Phillips affair began with an assault by a group of investors led by T.Boone Pickes. In defense, Philips designed a sweeping plan to reorganize its financial structure, including an agreement to buy Picken’s 5.7 percent stake for $53 a share, a premium price. The plan required shareholder approval. Suddenly Icahn entered the fray, announcing a stunning counterproposal to the shareholders. He would pay $60 a share for half the company’s stock – a total of $4.2 billion – and pay it in cash. Then he would issue securities valued at $50 to purchase the remaining stock.

"Is Icahn for Real?" asked Phillips in full-page newspaper ads, skeptical that the raider could amass such enormous sums of capital. Icahn parried with an ad of his own – "Is Phillips for Real?" – saying that Drexel Burnham Lambert had been able to raise S1.5 billion for him in only 48 hours.

The skirmishes grew even more heated as the big vote approached in late February. Phillips released white proxy cards to shareholders, with “Phillips Petroleum Co.” as the heading. Icahn distributed blue cards, with a remarkably similar design under the heading: “Phillips Petroleum Co. Stockholders Protection Committee.” Phillips executives were enraged. They viewed the Icahn cards as a deliberate, crafty attempt to dupe shareholders.

Three days before the vote, a crowd of about 40 citizens of Bartlesville, Oklahoma, where the company is based, burned a pile of Icahn proxy forms using Trop-Arctic motor oil, a Phillips product. The bonfire flared despite the onset of rain, and the drenched townspeople cried "burn, burn, burn."

Phillips and Icahn called a truce a few days later, when the company released a plan to swap new bond issues for shares of its stock. Icahn's holdings were worth over $75 million under this proposed buy-back; the time had come to strike a deal. Icahn dropped his tender offer and pledged that he wouldn't attempt another raid on the company for eight years. In exchange, Phillips agreed to pay Icahn $25 million of the estimated $30 million in legal fees he had accumulated in the battle.

Icahn followed the Phillips transaction with a raid on Uniroyal Inc. last April. A month later, he agreed to support a leveraged buyout of the company. Uniroyal paid Icahn $5.9 million for his expenses and cooperation, and he made over $68 million by selling shares back to the com-pany. Then came the TWA battle, the climax of Icahn's career.

Last August, before the cover of TWA's annual report had been added to the wall hangings in his company's lobby, a large, plastic-backed sign advertising the airline's "Good-Buy Fares" rested on the floor outside Icahn's office. The sign appeared to have been designed for display at travel agencies. It featured color pictures of landmarks from the European capitals – including the Colosseum and the Parthenon – with the corresponding air fares listed underneath. Conspicuously pasted on one of the plastic compartments was a photo of Carl Icahn.

But was TWA such a good buy? In a recent cover story titled "The Comeuppance of Carl Icahn," Fortune magazine scrutinized the deal. It noted that he had the right to back out when TWA's losses for the year reached $150 million. His decision not to, according to Fortune, had more to do with ethics than with legalities. The only other interested buyer was Lorenzo, and Icahn had promised the unions not to sell to Texas Air. Unable to arrange a leveraged buyout, he borrowed $750 million to shore up his acquisition.

With the airlines engaging in price wars and overseas traffic lagging because of terrorist attacks in Europe, TWA's stock fell to about $14 a share last month. That worked out to roughly a $73 million loss for Icahn. Though he risks losing face on this take-over, as Pickens did on Unocal, he also has the opportunity to focus his formidable skills on turning his acquisition around. In that way he could make believers out of cynics who don't put much stock in his oft-repeated claim that corporate raiders serve to protect shareholders from inept management.

_________________________________________________________________________

This was originally published in the February 26, 1986 issue of PAW.

No responses yet