Princeton Endowment Earns 46.9 Percent, Topping $37 Billion and Outpacing Peers

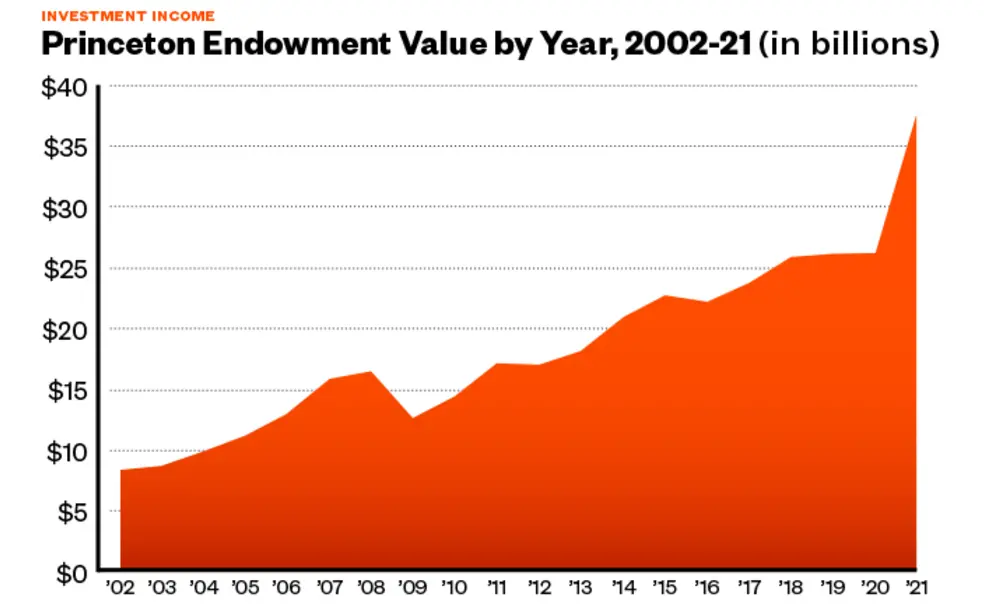

Princeton’s endowment earned a 46.9 percent return for the year ending June 30 — the largest rate of return since the Princeton University Investment Co. (Princo) was established in 1987 — and increased in overall value to $37.7 billion, according to a University announcement.

In a year of exceptional financial results throughout higher education, Princeton stood near the top of the Ivy League endowment results, behind only Brown, which reported a 51.5 percent return. All eight Ivies had returns of 32 percent or better. An August report from the Wilshire Trust Universe Comparison Service said that institutional assets enjoyed their best fiscal year since 1986, largely due to growth in U.S. equities.

For Princeton, private equity investments were the key growth driver, producing a 98.7 percent return, and within that portfolio, U.S. venture capital investments had triple-digit returns, according to Andrew Golden, the president of Princo.

While the one-year gains are remarkable, Golden said the work involved in investing in early-stage companies spans many years. “One should differentiate between moments of value recognition and spans of value creation,” he said. “It actually was in some sense a great decade of efforts that just happened to come to fruition at one point, when the markets became quite receptive to recognizing that value.”

Amid the uncertainties of the pandemic, Princo made some adjustments to ensure its liquidity position, which may have marginally dampened the year’s returns, Golden said. But he had no regrets about that decision, quipping that “just because it didn’t rain doesn’t mean it was a bad idea to bring an umbrella.”

Endowment distributions and other investment income will account for 66 percent of Princeton’s operating revenue in 2021–22, according to Michael Hotchkiss, a University spokesman. That percentage has been steadily increasing. In 2001–02, investment income covered 40 percent of the operating budget.

The endowment returns were announced less than a month after Princeton kicked off Venture Forward, a major engagement and fundraising campaign. Kevin Heaney, the University’s vice president for advancement, said in a statement to PAW that donors “seem buoyed by what a good steward the University has been.”

“Regarding the strong endowment returns we’ve seen this year, and consistently over the past two decades, many donors believe that supporting a well-managed institution leads to broader impact and has the potential to transform lives for generations,” Heaney said.

In May, the Board of Trustees announced plans for the University to dissociate from fossil-fuel companies that engage in climate-disinformation campaigns or are involved in the thermal coal and tar-sands segments of the industry. A faculty panel is advising trustees on the process and is due to make a public report by the end of the 2021–22 academic year, according to a September announcement by the University.

When asked about the time frame for divesting from specific firms, Golden said it would depend on what the companies are and how the University has invested in them. “Very little of the portfolio is held directly,” he said.

Ivy League Endowment Returns in FY2021

| Return | Total value | |

|---|---|---|

| Brown | 51.5% | $6.9 billion |

| Princeton | 46.9% | $37.7 billion |

| Dartmouth | 46.5% | $8.5 billion |

| Cornell | 41.9% | $10 billion |

| Penn | 41.1% | $20.5 billion |

| Yale | 40.2% | $42.3 billion |

| Harvard | 33.6% | $53.2 billion |

| Columbia | 32.3% | $14.4 billion |

Sources: Brown.edu, Princeton Office of Communications, Dartmouth.edu, Cornell Chronicle, Penn Office of Investments, Yale News, Harvard University Financial Report, Columbia Finance

2 Responses

Tom Hart ’71

4 Years AgoPrinco’s Performance

I just read with interest “Princeton Endowment Earns 46.9 Percent” (On the Campus, December issue). Can’t Old Nassau create some kind of Princo-tracker index fund for us to invest in, instead of suggesting we hand over our children’s inheritance? Sure, take some fees. Heck, I’d settle for 40 percent.

Peter J. Turchi ’67 *70 p’91

4 Years AgoFree Princeton

I applaud Princo’s bold but careful stewardship that has led this year to a nearly 50 percent increase in Princeton’s endowment (On the Campus, December issue). This provides a great opportunity for Princeton to demonstrate leadership among its highly endowed peers: Make a Princeton education free. Rather than simply expand the administration, and before Harvard and Yale realize a similar opportunity, there should now be adequate resources (less than 1 percent annual draw) to cover at least tuition, fees, and related expenses for all undergraduates. Thousands of secondary school students would be attracted early in their planning to an excellent education without concerns about the complexities and uncertainties of navigating financial aid. Princeton would have an immediate competitive advantage for the best of the best. The substantial increase in our endowment can thus power Venture Forward “to a day when Princeton can offer a transformative educational experience to a greater number of talented students, regardless of their socioeconomic background,” as the advertisement in the December issue said.