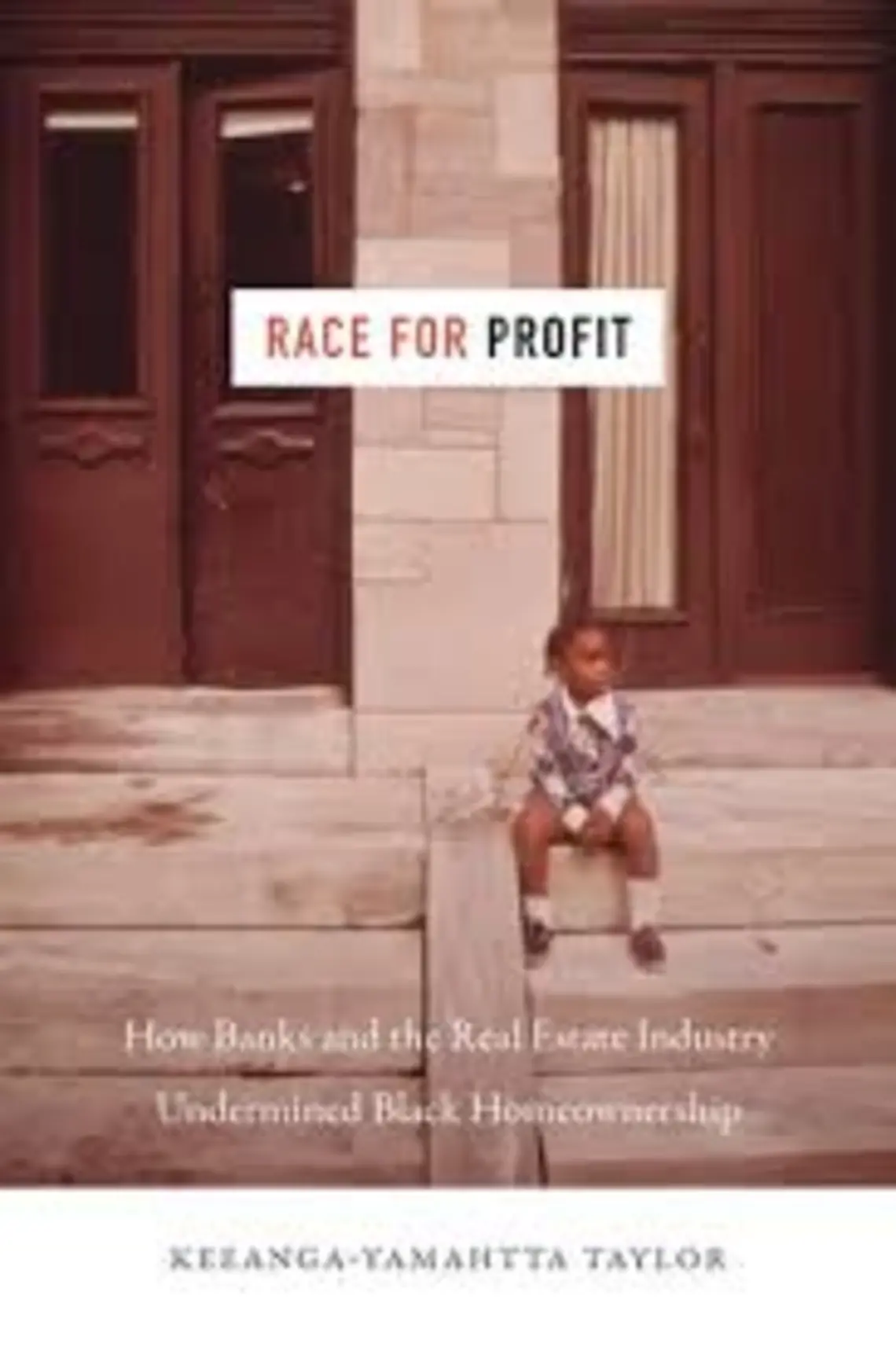

Race for Profit: How Banks and the Real Estate Industry Undermined Black Homeownership

This analysis of discrimination in housing focuses on the results of what African American studies professor Taylor deems “predatory inclusion”: after discriminatory redlining was banned in the late ’60s, lenders began to widely offer loans to underprivileged blacks whose mortgages would be guaranteed by the federal government. When these likely-to-default individuals fell behind on payments, the banks could foreclose, gaining further profit. Race for Profit (UNC Press) is an incisive history that argues for a non-exploitive approach to fixing the housing crisis.

Paw in print

Image

The Latest Issue

February 2026

Lives Lived & Lost in 2025, Saying ’yes’ to more housing; AI startup stars