Aaron Burr 1772’s Legacy as a Banker Lives On

This year marks the 250th anniversary of the founding of JPMorgan Chase, which traces its history to the Manhattan Company, and which Aaron Burr 1772, shepherded into existence. Burr was known for the duel he fought with Alexander Hamilton on July 11, 1804, and for his misadventures to the western territories following the gun battle at Weehawken. However, it's his work as a banker that lives on in a big way in JPMorgan Chase.

Following the conclusion of his Revolutionary War service and his admission to the New York bar, Burr ventured into politics to become New York attorney general and a New York state assemblyman (twice) before becoming United States vice president. During his second term as a New York state assemblyman, Burr wrote the charter for the Manhattan Company to set up a corporation to bring clean water to lower Manhattan that had been afflicted by yellow fever outbreaks, a disease thought to spread through contaminated water. Burr brought on board Hamilton and several other Federalists to champion a private water company as a means of avoiding raising taxes to fund a public water company.

After the charter received final clearance from a legislative panel dominated by Federalists, Burr added a clause that would permit the Manhattan Company to use surplus capital “in the purchase of public or other stocks or in any other monied transactions or operations, not inconsistent with the constitution and laws of The State or the United States.”

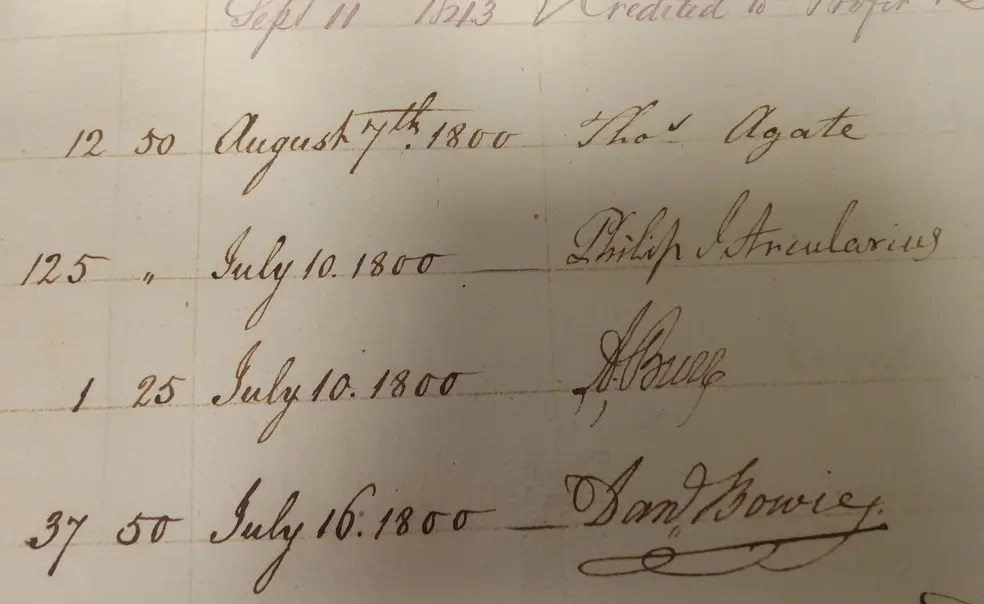

On Sept. 2, 1799, the Manhattan Company opened “an office of discount and deposit” and began lending its surplus funds to Burr and other Democratic Republicans. They had previously had loan requests to the Bank of New York, a Federalist bank set up and controlled by Hamilton, denied. Hamilton cut his ties to the Manhattan Company once he found out its additional purpose.

The Manhattan Company did fulfill its original purpose by laying a network of pipes made from hollowed pine lumber. It distributed clean water in Manhattan until 1842. As detailed in The History of JPMorgan Chase (2021), “The Bank of The Manhattan Company outlived the waterworks and became one of the leading banking institutions in the nation — lending money and underwriting bonds, for instance, to help finance the Erie Canal, which opened in 1825.”

The Manhattan Company merged with Chase Bank in 1955 to become Chase Manhattan Corporation, and that entity purchased JPMorgan & Company in 2000. At the time, Chase Manhattan Corporation was the third-biggest banking company in the United States. The transaction was an all-stock deal valued at around $30.9 billion.

No doubt Burr’s brilliance that led to the creation of the Manhattan Company was foreshadowed by his time at the College of New Jersey (Princeton’s original name). As an 11-year-old, he applied to be admitted as a junior to the institution co-founded by his father, Rev. Aaron Burr. Turned down but not deterred, he reapplied two years later and was admitted as a 13-year-old sophomore. He graduated in 1772 at the age of 16. He subsequently studied to become a minister to follow in the footsteps of both his father and his maternal grandfather, Rev. Jonathan Edwards, the institution’s third president. The Revolutionary War intervened.

Given his subsequent career choices as a lawyer and politician, Burr would probably be surprised to know that he can also be remembered as a banker. JPMorgan Chase is now the largest bank in the United States and the fifth largest in the world, with reported total assets exceeding $4 trillion. By contrast, the Bank of New York Mellon (which resulted from a merger with the Mellon Financial Corporation in 2007) is 83rd on the list of the world’s largest banks with reported assets of approximately $410 billion.

If the finances are the gauge, then Burr as banker exceeded Hamilton’s ventures into the banking arena. That both men’s banks continue today remains a testament to their foresight into the new nation’s economic needs.

Sherri L. Burr *88 is a descendant of Aaron Burr 1772 and emerita professor at the University of New Mexico School of Law.

No responses yet