On Tax Reform & America’s Future

In placing the general interest ahead of the special interests the 1986 Act is a return to the values of the Founding Fathers

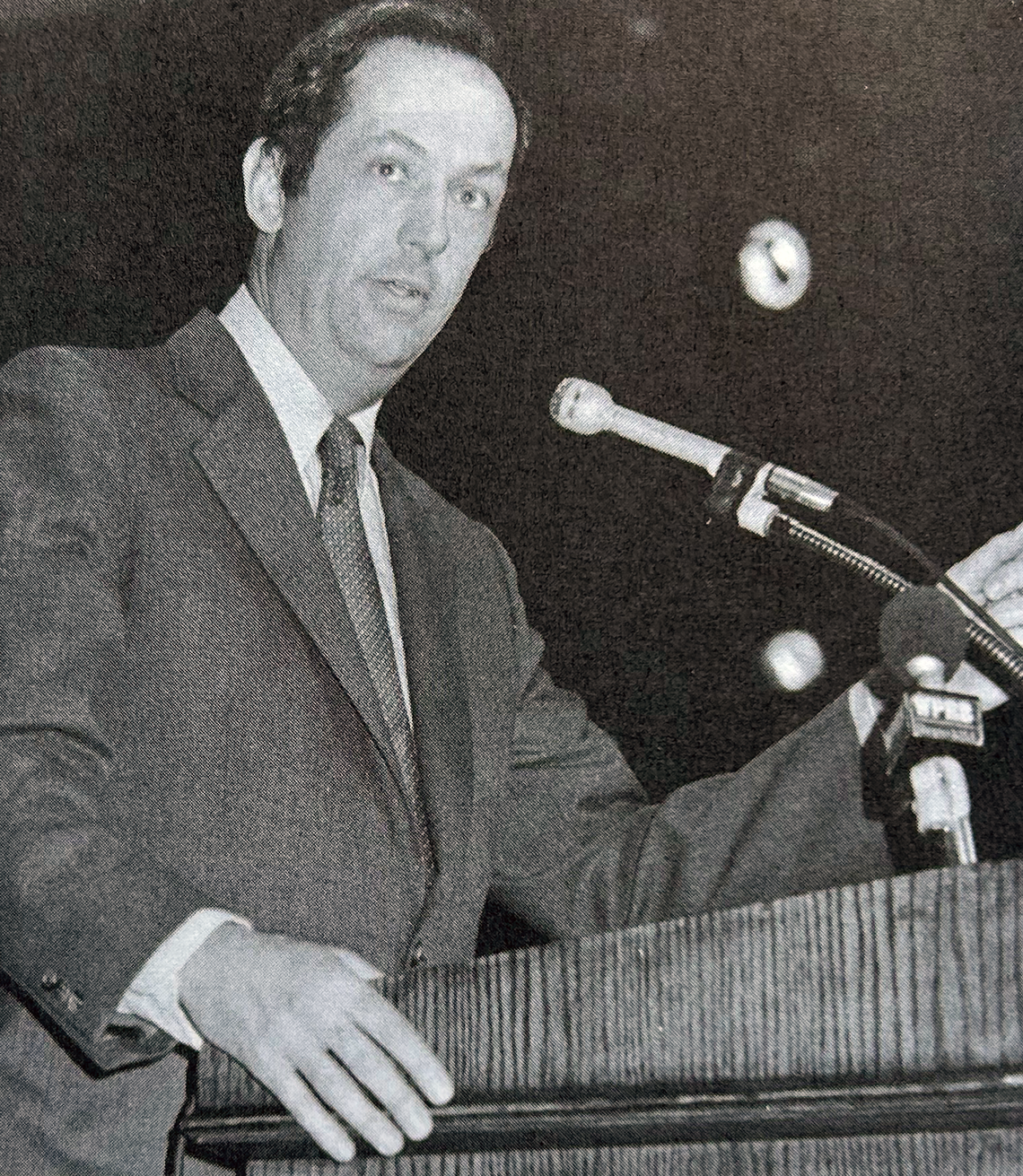

Senator Bradley was the originator and one of the leaders of the movement that resulted in the tax reform act passed last summer. This is adapted from the talk he gave in Alexander Hall on the morning of Alumni Day. The boxed excerpts are from the question and answer period that followed his speech.

Some, including my wife, Ernestine, would say that tax reform has been my obsession for the last several years. Indeed, I think our daughter would confirm that. One Sunday afternoon I was on a half-hour television broadcast that had been taped earlier in the week. She was in the room with one of her little friends when it came on, and I asked her, “Don’t you want to watch Daddy on TV?” She looked at her six-year-old friend and said, “Let’s go—all he’s going to talk about are loopholes.”

So it has been an obsession and it has happened. Not since 1913, when the Congress passed our first income tax, has there been a tax reform act of such sweep and significance. It has importance for all of us. One hundred million households file tax returns each year. More people in America filed a tax return last year than voted in the Presidential election of 1984. Taxes influence some of our most important personal choices: where to live, whether to buy a house, how much to save, how hard to work, in what form to take our pay. Taxes influence the companies that Americans work for: the mix of goods and services they produce, where the new jobs are created, what kinds of investments get made, which firms flourish, and which industries falter.

Taxes also shape the way Americans feel about their society: whether they believe its laws are just, whether government is sensitive to their needs and aspirations, whether the men and women who represent them care about the general interest, or whether they serve the narrow, special interests that too often seem to have wrested control of our political life.

Talk of taxes always involves talk about dollars—billions and billions of dollars. Politicians shuffles these impersonal numbers from one column to another, like a bunch of accountants concerned only with the bottom line.

But remember: tax reform is not just about money. It’s about personal dignity and individual security. It’s about being in control of our lives while having a government that is responsive to us. Most important, tax reform is about hope: hope for poor people striving to give their families the chance of a better life, hope for the elderly struggling to get by on fixed incomes, hope for young couples priced out of the American dream of home ownership, hope for the worker who’s lost his job and whose future depends on a buoyant economy.

I’m proud to have been a part of the effort to give the American people what they deserve—lower rates of tax and a fairer income tax system in which people with equal incomes pay about equal tax. My interest in tax reform goes back 20 years. When I first started playing professional basketball, my tax attorney told me: “You have to decided how much you want to pay in taxes.” At the age of 23, that seemed hard to believe. “What does he mean?” I asked myself. He proceeded to explain—shortly after I had negotiated my first contract with the Knicks—that I could take my pay as salary, or defer part of it, or take it as property, or as a longterm consulting contract, or as employer-paid life insurance and pension plans, or as payment to my own corporation or…

“Look,” I said. “I just want to be paid well for doing something I love.” He answered, “It’s not that simple.” Indeed, it isn’t. But it ought to be. And now I think it can.

Paying taxes shouldn’t be something people do on an optional basis. Oliver Wendell Holmes said: “Taxes are the price we pay for a civilized society.” And everyone should pay his or her fair share. That’s the premise of the 1986 tax reform act—fairness. No more opting out of your responsibility as a citizen of this country just because you’ve got access to talent will allow you to milk a loophole.

Loopholes for the few mean high rates for the majority of middle-income Americans, who with their taxes pay the freight for government. Just 20 years ago, loopholes cost the treasury about $37 billion a year. In 1986, loopholes cost about $450 billion a year—that’s about the same amount as we actually collected last year in personal and corporate income taxes combined.

Closing loopholes allows tax rates to be cut for everybody. Under the tax reform act, four out of five people will pay about 15 percent and no one’s rate will exceed 28 percent, expect for that class between $100,000 and $200,000 where there is a blip up to an effective rate of 33 percent. Everyone is better off because they are allowed to keep more of what they earn—keep it to save or spend as they please on what they want—not on what the tax code dictates.

Now, the special interests don’t like or want lower rates. The special interests flourish in a world where tax rates are 70 or 80 or 90 percent, with full deductibility of their thing—whether it’s oil wells, office buildings, race horses, or avocado groves. With an army of tax advisers, they exploit the loopholes to shelter income and end up paying zero taxes, while Mr. and Mrs. Middle-Income American are stuck with high rates.

How could we expect only some Americans to pay for our national security, our schools, our health care for the elderly, our programs for the poor, our roads, subways, and ports. How could we expect them to pay when they knew so many others were getting a free ride. The answer was clear. We could not. And in the 1986 tax act, we looked at the special interests and said, “Get on board, be a part of the community, be a part of America, pay some tax.” We have taken a step to remove the web of suspicion and inequity that covered our tax system. And we have taken a step toward restoring trust in government.

A few years ago, I was seated on the dais here in New Jersey next to a major corporate figure of the state and sometime during the salad he said, “You know, Senator, I’ve got a major problem with my son.” In politics, we call that a “threshold question.” Do you follow up? But it was 1984 and I was up for re-election, so I asked, “What’s the problem?” He said, “My son is 17 years old, works for a company, but all he can think about is how to avoid paying tax. I tell him, ‘Look, go to work every day, learn your business, move up, and pay your fair share.’ But all he can think about is how to avoid paying tax. Senator, I’m concerned that there’s a whole generation of young Americans out there who believe they have no responsibility whatsoever to support the legitimate functions of the government.”

Indeed, we all should be concerned, because voluntary compliance has been at the core of our tax system. By taking a step toward tax reform, we are saying that everyone will pay his fair share, and I think it will rejuvenate trust in government.

As we debated this bill last year, we took off our green eyeshades and saw tax reform in its human context. Who are the people who pay for our “civilized society”? What do they do? What do they earn? What do they hope for?

First, it seemed as we began the debate that many Senators and Congressmen had the notion that the average American made about $75,000 a year. That notion had led our tax policy astray and led us to think that tax reform was not possible. But what are the facts? Only 0.5% of all taxpayers make over $200,000. Only 12.4% of all taxpayers make between $40,000 and $75,000. Nearly 85% of all American taxpayers make $40,000 a year or less.

Second, we should know that over the last 10 years, the taxes Americans pay have increased faster than the wages they earn. This means that in 1986, the real after-tax income was lower than in 1975.

Third, we should know that the number of people living in poverty has risen from 9 percent in the 1970s to 14 percent today, and many of the poor—until tax reform—paid more in tax than some people making considerably more money.

Who are the 85% of the taxpayers with incomes of $40,000 or less? Nearly 32 percent of American taxpayers make less than $10,000 a year; about 21 percent earn between $10,000 and $20,000; and another 32 percent make between $20,000 and $40,000. How do they live and what do they do?

Most of them are married couples. Indeed, about three-fourths of the non-dependent adult population in America are married persons living in the same household. But the number of single heads of households is on the upswing. So providing relief for both groups is very important. The tax reform act did provide relief for both married and unmarried Americans. Let’s take a family making $20,000. Where do they live? Probably in rental housing without air conditioning. What do they do for entertainment? Not an expensive lunch, that’s for sure. They rely on free public recreational facilities—the park, the playground, the public beach. They eat more potatoes and less meat. They drink beer, not wine. They ride the bus or subway to work. They have a strong sense of self-respect. They hope for their children. They are proud of being American. They don’t claim any itemized deductions. So they’ll be glad that the reform act provides a bigger personal exemption and a more generous standard deduction.

How about a family making $35,000? They may own their home, but they probably have 15 years left on the mortgage. Their family budget allows for the following: a new suit every 3-4 years for Dad; Mom gets 2-3 new dresses every couple of years; a new TV set every 10 years; a new fridge every 17 years. They won’t be too concerned about the loss of the consumer interest deduction because they aren’t buying all that much. They get to the movies about nine times a year but, of course, they don’t benefit from the entertainment expense deduction. They have no savings—no financial assets. They simply can’t afford to save. And if there’s anything left over, they’ll buy a used car. This family will be glad that the reform act gives them lower rates and continues to allow deductibility of mortgage interest and property taxes so that they can keep more of the money they earn. They will also be glad that they continue to receive health benefits tax free.

Now let’s look at a family that’s relatively well off, making $75,000 a year. More likely than not, they’ll be a two-earner couple. At income levels between $40,000 and $85,000, a majority of wives work. (Interestingly, this pattern changes at the highest income levels, where most wives aren’t in the paid labor force.) The $75,000 family will be pleased with the low tax rates and the reduction in the marriage penalty that the reform act provides, because as they advance in their respective careers they won’t have to bother with tax shelters to achieve financial security. They can concentrate on what they do best—their professions.

I want to emphasize just how important this kind of data is to the tax policy debate. We didn’t make up rules to benefit just a few. This tax affects all Americans. And it’s important to know who they are, and how they benefit in order to make sure the general interest is served.

To repeat, 85 percent of all taxpayers make $40,000 or less. The median income in America is $23,450 (that means half the people earn more and half earn less). These are the real middle class, the backbone of the country. And what is especially worrisome is that their numbers are shrinking. In 1978, some 52 percent of Americans were part of the middle class (defined as between $19,000 and $47,000 in income); in 1986, only 44 percent were. Over two thirds of those who left the middle class saw their income status decline, while only a third saw it rise.

Another ominous set of statistics concerns expectations. In the 1950s a person entering the work force at age 25 could expect to earn 116 percent more by the time he was 35. In the 1960s a person entering the work force at 25 could expect to earn 118 percent more by age 35. But in the 1970s a person entering the work force at 25 could expect to be earning only 14 percent more by 35.

I believe we had and have an obligation to reverse that trend. America has always been the land of opportunity. Our commitment to equality of opportunity is the bedrock of our democracy. The optimistic faith of the American has always been that if you work hard, you will get ahead. Opportunity, optimism, democracy. That’s what tax reform was all about. That’s what the 1986 act embodies.

The reform act takes 6 million low-income people off the tax rolls. How can a compassionate society not want to life this unconscionable burden off those least able to pay? For these taxpayers, reform means work instead of welfare, dignity instead of despair. In fact, the single parent with three children making $14,000 a year as a family will pay $1,200 less tax next year as a result of this bill.

The reform act lowers middle-income families’ tax rates and it also protects those deductions such as mortgage and property taxes that most of them utilize. The result is that they will receive in most cases cuts in taxes. And it says to these families: you keep more of the money you earn. If you get a better job, make more money, you’ll still only pay 15 percent in taxes. In other words, you’ll get to decide how to spend that money.

There will be those who will say we could have given middle-income taxpayers even more. Maybe, but make no mistake. The tax reform act is the best thing middle-income people have seen in a generation. And the reason we fought to give the backbone of America, the middle class, a break is simply that they deserve it. Tax reform means that everyone, not just a few, gets a tax break and a better chance to prosper. By putting together a balanced reform act that benefits all classes of taxpayers, we got the kind of support embodied in the 20-0 vote out of the Finance Committee, and the nearly 90 votes for final passage in the Senate.

There’s another important sense in which tax reform is about opportunity and optimism. Tax reform is about economic growth as well as fairness. Opportunity and optimism thrive on growth, on recognizing that embracing the change is the key to America’s future. This means a tax system that facilitates change and rewards innovation, not one that enshrines the status quo, subsidizes the politically powerful, and shortchanges America’s potential for growth.

We can’t compete internationally unless our capital and labor are allocated efficiently. But under the old system, it was the politicians who were telling people wat kind of investments to make. We celebrate markets and entrepreneurship, yet we centrally planned our economy through the tax code and with no oversight.

Last year we realized that we can’t solve the problems plaguing our farms without repealing the loopholes that depress farm prices, encourage overproduction, inflate the value of farmland, concentration ownership and toll the death knell for the family farmer. We realized that we can’t modernize our industrial base without eliminating the loopholes that glut us with shopping malls, hotels, and office buildings, while starving our factories and industrial plants. We realized that we can’t boost savings and investment while the tax laws are telling us to borrow and consume. And we can’t make the dollar more competitive and create jobs for American workers while the tax system is keeping interest rates artificially high.

When I talk to business people in New Jersey and across the country, I ask them: who do you think does a better job of running the economy—the Congress or the market? What do you think they answer? The market, of course. And I agree with them. The promise of tax reform, then, is fairness and growth, opportunity and optimism, economic security and a better life, dignity and hope.

There are those who look at the reform bill that was passed in 1986 and say it will soon be undone. I disagree, the W-4 form notwithstanding. There was a political realization in the passage of tax reform as well as the economic fact. The numbers that are key to understanding the difficulty of making changes in this bill are the ones about total loopholes. As I pointed out earlier, in 1967 the value of all loopholes was $37 billion; in 1985-86 it was $450 billion. The problem for a politician from 1967 to 1982 was a pleasant one: how to spend the surplus. The combination of growth and inflation always brought government more money that it had the year before.

One of the ways that Congress spent the money was on important programs related to education and the environment. But by far the biggest was by increasing the size, number, and value of loopholes. One thing that Congress did not do throughout that period was to cut tax rates on middle-income taxpayers. In 1986 we did—four out of five paying a 15 percent tax rate. Consequently, if the growth rate drops four-tenths of a point over the next quarter or so, and someone says, “Ah-ha, the answer is the investment of tax credit; put it back,” that is no longer a free choice. By putting the investment tax credit back you will increase the deficit $15 billion. So as a result of tax reform, as a result of cutting rates on middle-income taxpayers, spending through the tax code is now put on the same plane as spending through the appropriations side of the budget. And therefore those who expect to dismantle the work of the 1986 Congress I think are—sadly for them, hopefully for the rest of us—mistaken.

The underlying issue of tax reform has been with us since the beginning of America. Some people say that our Founding Fathers saw the general interest as a composite of special interests shaped by the institutions of our democracy to limit excess and to ensure stability. In fact, though, from the very beginning, our Founding Fathers reserved their highest praise for those who acted in the general interest. They believed that the narrow interest of faction was going to give way to the general interest of community. Tax reform is the call to return to the values of our first leaders and that is why it can’t be dismissed without simultaneously diminishing our heritage.

I believe that it is the right policy bridge between a past we’re proud of and a future we’re unsure about. It is a choice about ourselves. It’s a choice that a number of Princetonians helped make real to the American people—from Jim Baker (’52) to Roger Mentz (’63) to the Finance Committee. And in 1986, I think we made the right choice.

This was originally published in the March 11, 1987 issue of PAW.

0 Responses