Diversified Strategy

Endowment valued at $18.2 billion after investment return of 11.7 percent

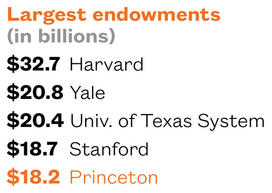

Princeton’s endowment enjoyed an investment return of 11.7 percent in the year ending June 30, slightly above the University’s average investment performance over the past decade, the Princeton University Investment Co. (Princo) announced Oct. 18. The endowment finished the academic year at $18.2 billion, up from $17 billion in 2012, after taking into account investment returns, gifts received, and spending from the endowment.

The performance suggests a more routine investment environment for Princeton after a period of stark lows and highs. Just four years ago, the University announced it had lost nearly a quarter of its endowment value in the financial crisis, leading to predictions that it could take a decade to rebound. But the endowment made up its losses in just two years, and it has risen since then.

The return this year trailed the overall U.S. stock market, as measured by the Standard & Poor’s 500 index, which jumped 18 percent over the same period. But the performance is slightly better than the University’s annualized 10-year return, which inched up from 9.9 percent between 2003 and 2012 to 10.2 percent between 2004 and 2013. The new annualized return compares to a 7.3 percent average growth in the S&P 500 during the same period.

The University trailed the U.S. stock market this year because the endowment is invested in a diversified set of assets, both domestically and abroad.

“We’re taking a much more diversified approach,” Princo president Andrew Golden said in an interview, noting that “this is a year where diversification is not rewarded.” But he added that “having your eggs in more than one basket is still a safer approach than just counting on the U.S. stock market.”

Investment returns reported by Princeton’s peer universities ranged from 14.4 percent at Penn to 11.1 percent at MIT. Aside from Rockefeller University, which has an enrollment of about 200 graduate students, Princeton leads other colleges in endowment per student — $2.3 million, based on the latest figures.

Princeton’s best return this year — 34 percent — came in international developed markets. Investments in the U.S. stock market enjoyed a 22 percent bounce. Investments in emerging markets were up 8 percent, and private equity was up 10 percent. Fixed income and cash investments broke even, while investments called independent return — which bet on specific circumstances such as whether a biotech company will get approval for a drug — climbed 17 percent. Real assets like commodities and real estate returned 8 percent.

This year, Princo is targeting 8 percent of its endowment in U.S. equities, 6 percent in stocks in developed countries, 11 percent in emerging markets, 24 percent in independent return, 23 percent in private equity, 23 percent in real assets, and 5 percent in fixed income.

In a statement, Provost David Lee *99 said the endowment’s performance enables the University to continue a generous financial-aid program, which he said makes the average cost of attending Princeton today less than it was in 2001.

No responses yet