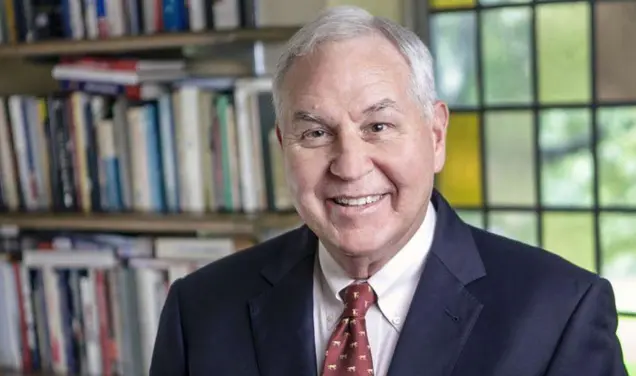

José Quiñonez *98 is a different kind of loan officer. His clients are primarily low-income immigrants with little or no access to credit from traditional banking institutions. His loans come with no fees or interest payments; clients borrow from each other.

The founding executive director of the San Francisco-based Mission Asset Fund (MAF), Quiñonez has brought immigrants into the financial mainstream, turning what had been a traditional way for low-income people to access credit — lending circles — into a formal credit-building process.

Called tandas in Mexico, susus in much of Africa, paluwagan in the Philippines, and lun-hui in China, lending circles bring together a group of people who make an agreement — that each will contribute $100 a month for 10 months, for example. Every month, that pool of money goes to a different member of the circle. After 10 months, each person has saved the equivalent of the so-called loan, and all but the last person in the circle received that amount in a loan before they could have saved it themselves.

In MAF’s version, members must have checking accounts and make payments and receive funds by automatic deposit and withdrawal. The fund manages the accounts, tracks payments through Citibank, and reports transactions to credit agencies. After three and a half years and nearly $1 million managed, the program has a default rate of zero.

Micaela and Bruno Nabor are one couple who have benefited from MAF’s lending circles. Natives of Mexico, the Nabors opened a small silk-screening T-shirt shop in San Francisco with the money they received from two rounds of lending circles. Today, the couple have a new car — one purchased with a traditional car loan that they qualified for, thanks to the credit they built through the lending circles.

The program is spreading. Other organizations — including the Pilipino Workers Center in Los Angeles and the Chinese Newcomers Service Center in San Francisco — have adopted the MAF lending-circle model.

In early 2012, MAF unveiled a new use for lending circles: citizenship tandas. The new program harnesses lending circles to pay the $680 fee required for U.S. citizenship. Studies have shown that the fee is high enough to block citizenship for many immigrants.

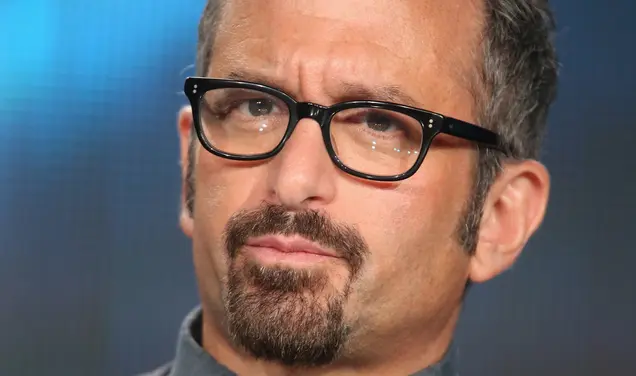

Wendell Largo, a former school teacher from the Philippines, is the first in his citizenship tanda to receive the funds for his citizenship application. The program puts together six people ready to apply for citizenship and supplements their savings with a grant from the Silicon Valley Community Foundation. Instead of paying $680, they pay $510.

“One hundred and seventy dollars is a lot for those of us who work for $10, $8, $9 an hour,” Largo says. “Most of us doing the tandas, our budgets are tight, especially nowadays.”

Quiñonez, who earned a master’s degree in public affairs, knows many of the challenges immigrants face firsthand. After coming to the United States from Mexico in 1980, Quiñonez became one of an estimated 3 million undocumented immigrants to receive amnesty and a chance to become a U.S. citizen under the Immigration Reform and Control Act of 1986. “Immigrants are savvy economic actors,” he says. “The reason I went to Princeton, and the work I’m doing now, is really about helping society see the value of immigrants.”

No responses yet