The no-loan pledge, a decade later

More students receive financial aid, and more offered aid are choosing to enroll

Beginning in the late 1990s, Princeton’s trustees approved a series of financial-aid enhancements that culminated with the January 2001 decision to replace loans with grants. Ten years later, the number of aid recipients has significantly increased, and the no-loan model has influenced the aid programs of several peer institutions.

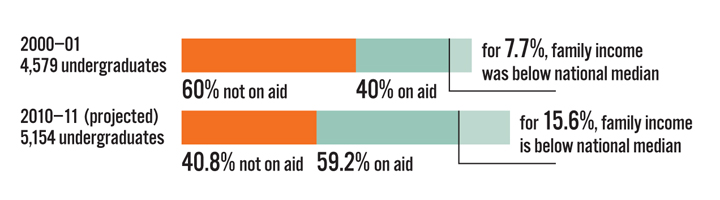

At Princeton, the proportion of undergraduates on aid made a steady climb from 40 percent in 2000–01 to 59.2 percent this year. Elsewhere, eliminating loans has become a popular way to appeal to low- and middle-income applicants. According to the nonprofit Project on Student Debt, 55 schools — including all eight Ivies, Stanford, and MIT — have made a no-loan pledge to all or some of their financial-aid recipients.

Princeton’s path to financial-aid reform began in the mid-1990s, when administrators noticed that the University had stalled in its efforts to enroll undergraduates from modest socioeconomic backgrounds. Then-president Harold Shapiro *64, an economist, understood that, in theory, loans should not deter students who were likely to earn high salaries after graduation. But in practice, he said, “It didn’t work that way.” Student loans were a significant barrier, particularly for low-income families who’d had negative experiences with other types of loans.

Backed by strong endowment gains, Princeton eliminated loans for all students who received aid in the fall of 2001. Dean of Admission Janet Rapelye, who headed admissions at Wellesley College at the time of Princeton’s announcement, said that many in higher education viewed the policy change as a “trendsetting moment.” But others questioned the University’s action, believing that it was motivated by competition.

“That was the knee-jerk response that we got initially, especially from our closest competitors,” recalled Shapiro. “Our hope was that they would follow us, not that we would have a competitive advantage.” He said he expected that within a decade, “our competitive situation would be unchanged, but the socioeconomic composition of students would be shifted.”

Though the schools most often vying for Princeton’s admitted students all have no-loan financial aid today, Prince ton has indeed become more successful in enrolling students who are offered aid. Before the no-loan policy, Princeton’s yield on students offered aid consistently lagged behind the yield for non-aid students, according to Robin Moscato, director of undergraduate financial aid. In 2000, 63 percent of prospective freshmen offered financial aid enrolled at Princeton, compared with 73 percent of the admitted students who were not offered aid.

In recent years, those figures have converged, and in 2010, the yield for admitted students who were offered aid (58 percent) exceeded the yield for those not offered aid (56 percent). Princeton’s overall yield figures dropped after the University’s elimination of early decision in 2007–08.

Rapelye said that the aid program — and extensive efforts to reach out to students who might benefit from it —– played a significant role in the growth of Princeton’s applicant pool, which has nearly doubled in the last 10 years. Another change is the higher proportion of middle-income students in the undergraduate student body. Before the no-loan policy, students who received financial aid and came from families with incomes above the national median made up about 32 percent of undergraduates. Today, that category comprises more than 43 percent of undergraduates.

The University also has doubled the representation of students from families earning less than the median income for U.S. households with children. The number of undergraduates receiving federal Pell grants has grown as well. Moscato said that the proportion of Pell recipients is likely to reach 12 percent this year, compared with about 6 percent in the years before the no-loan policy (an expansion in the Pell program has helped, Moscato said). Pell grants generally go to students whose families earn less than $40,000, and Princeton historically has lagged behind its peers in enrolling Pell recipients, ranking last among the Ivies in 2009–10.

The no-loan policy’s impact on graduates is less clear. In a 2007 working paper, Princeton economists Cecilia Rouse and Jesse Rothstein compared graduates from no-loan classes with graduates who predated the policy change. They found that a small but statistically significant portion of students who benefited from the elimination of loans shifted to more modest-paying jobs in education, government, or nonprofits.

Looking back, Dean of the College Nancy Weiss Malkiel said that Princeton went from “underachieving” in financial aid to taking a leadership role, and that changes instituted in 2001 have helped to make education more affordable. “Private higher education is more available to students of more mod est means,” she said. “From my point of view, that’s as it should be.”

No responses yet