Princeton’s endowment earned a 12.5 percent return for the year ending June 30, increasing in value by $1.6 billion to $23.8 billion after gifts and spending were factored in.

The results showed a clear rebound from the previous year, when the investment return was less than 1 percent and the endowment’s value dropped by $570 million.

Nevertheless, the investment performance was below average: During the last fiscal year, the average return for 450 endowments and foundations tracked by Cambridge Associates, a research and advisory organization, was 12.7 percent.

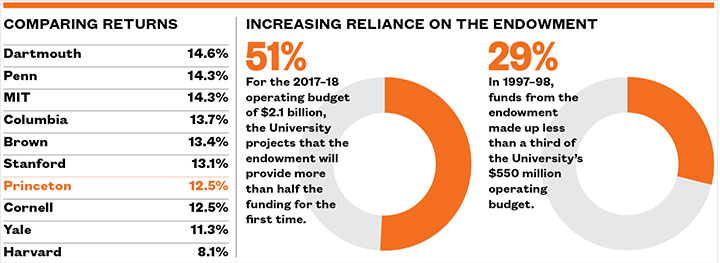

Dartmouth (14.6 percent), Penn (14.3), MIT (14.3), Columbia (13.7), Brown (13.4), and Stanford (13.1 percent) all reported higher investment returns, while Cornell’s rate of return equaled Princeton’s. Yale reported a return of 11.3 percent as its endowment grew to $27.2 billion. Harvard, whose $37.1 billion endowment is the largest of any college or university, described its 8.1 percent result as “disappointing.”

Andrew Golden, president of the Princeton University Investment Co. (Princo), said Princeton’s results were “solid in the absolute sense, and a little bit weaker” compared to peer schools, citing the University’s smaller investment allocation — identified by Princo as 20 percent — in publicly traded stocks.

The U.S. stock market began a bull run after the 2016 election, in part on the expectation that the Trump administration would cut business taxes and reduce regulations. Soaring stock prices “lifted our boat,” Golden said in an interview, but perhaps not as much as schools more heavily invested in the public markets. The S&P 500 rose 15.5 percent for the year ending June 30.

“We’re not trying to surf the waves,” he said. “We’re just trying to do what makes sense over the long term.” The endowment’s average yearly return over the last 10 years is 7.1 percent. For the last 20 years, the University said, the endowment’s average annual return is 11.6 percent.

Asset classes that proved to be big winners in the past year included emerging-market equities, which rose by 28 percent, and developed international markets, which rose by 24 percent. Private equity was up 12 percent, and independent return — such as hedge funds that bet on specific events — was up 9 percent. Real assets, such as real estate and commodities, grew by 8 percent, while fixed-income and cash incurred a 1 percent loss.

The University’s 2017–18 operating budget calls for spending about $1.1 billion from the endowment. That will provide about 51 percent of Princeton’s income for the year, up from about 48 percent last year. The University has increased the amount it is drawing from the endowment to finance priorities that emerged from its strategic-planning work.

Golden said he was generally optimistic about the future, but said the run-up in prices had made it more difficult for endowments to find cheap deals and generate meaningful returns. Many financial managers who invest on Princeton’s behalf have expressed a reluctance to take on more cash, he said.

“This is probably a somewhat below-average opportunity set that we’re collectively facing,” Golden said, “but it’s not kind of screaming ‘bubble territory.’”

While management fees continue to be a target of critics, Golden said he was comfortable with the fees collected by the approximately 80 outside firms that Princo works with. The best fund managers have skills that make Princeton money “even after the fees that we pay,” he said. “We believe we need to optimize fees, not minimize fees.”

No responses yet