Paul Volcker ’49 is worried, and that should make people nervous. If anyone knows what a crisis looks like, it’s the 91-year-old former chairman of the Federal Reserve Board, who presided over the central bank from 1979 to 1987.

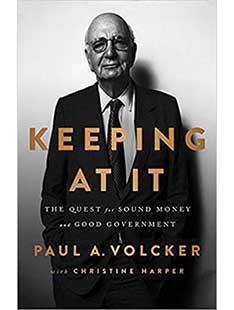

A towering figure in every sense of the word (at 6-foot-7 he played on Princeton’s varsity basketball squad), Volcker recounts in his new autobiography, Keeping At It (PublicAffairs), how he helped the nation navigate several major financial threats — from the ending of the gold standard in 1971 to the war against stagflation from the mid-1970s to the early 1980s, to the global financial crisis that began in 2007.

But while Volcker is best known for his lifelong interest in sound fiscal and monetary policy — which began with his senior thesis on the Fed and culminated with his efforts to combat double-digit inflation in the Carter and Reagan administrations — this time his concern is centered on government itself.

Specifically, Volcker, the son of a city manager, is worried that the public has lost faith in the ability of government and policymakers to get things done for the greater good. “The government has been rather gravely wounded,” Volcker said in a recent interview. He notes that when Americans are asked if they trust their government in Washington D.C., only around 20 percent say yes, down from 75 percent a generation ago. Faith in state and local government is somewhat higher, but polls show trust there is falling as well.

Yet the stakes are high. As he points out, the federal, state, and local governments collectively spend nearly 40 percent of the country’s total economic output.

For a policymaker who came of age in the post-World War II era, when government work became professionalized, America’s distrust of government — and the lack of incentives for professionals to remain in the public sector — is a hard pill to swallow.

Part of the reason for this distrust, he says, may stem from decades of middle-class economic dissatisfaction with the government’s ambivalence about the growing concentration of wealth. And part of it is political. Volcker points out in his book that “Ronald Reagan could always win applause by announcing that ‘government is the problem.’” While Volcker concedes that in some cases, government may be the problem, “it also happens to be a necessary part of our national being and of a successful society,” he writes. As a result, he argues, “we’d better make it work effectively.”

Toward that end, Volcker — who chaired two national commissions on public service — is leading a third effort to address this challenge. The Volcker Alliance, established in 2013, seeks to find ways to restore faith and efficiency in government through increasing responsiveness, transparency, and recruitment efforts; encouraging innovation and new technologies; and promoting an independent civil-service system.

A tall order, perhaps — but in Volcker’s opinion, not an insurmountable one. “We’ve gone through really big, messy wars, and we’ve had other global crises. And we’ve survived it all,” he says.

Another theme that’s woven throughout Volcker’s book: The more things change, the more they stay the same. Case in point: President Trump’s recent use of Twitter to denigrate the policies of Federal Reserve Board Chairman Jerome Powell ’75 — whom he appointed — for raising interest rates.

“Obviously, we haven’t had a president like this,” Volcker says. But, as he points out in his book, presidents have attempted to exert political influence over past Fed chairmen — including him.

He recounts a meeting with President Reagan and Chief of Staff James Baker ’52 in the summer of 1984, months before the presidential election. The president, who was seated, didn’t say a word. “Instead, Baker delivered a message: ‘The president is ordering you not to raise interest rates before the election,’” Volcker recalls in his book.

“I was stunned. Not only was the president clearly overstepping his authority by giving an order to the Fed, but also it was disconcerting because I wasn’t planning tighter monetary policy at the time,” he writes.

What did Volcker do? He walked out without saying a word.

But now, it’s his time to talk — about what it will take to make government great, or at least effective, again.

1 Response

Norman Ravitch *62

6 Years AgoA Profile in Courage

So Trump is not the first president to try to turn the Federal Reserve into his plaything for electoral benefit. Volcker in 1984 had to take the same from James Baker in the presence of a silent Ronald Reagan in the Oval Office. Volcker just walked out without comment after Baker made his pitch. We need more Profiles in Courage like Paul Volcker. They are a rare breed currently, perhaps always in fact. I wonder why Reagan said nothing at the time, leaving it to his chief of staff to make the inappropriate pitch. I voted for Reagan twice, but not because I really thought much positive about him. I remembered him as governor of California during my long residence there and knew what he was: an actor. Our current president is also an actor, a much more dangerous one than Ronnie Reagan.