PAWcast: Ashoka Mody on the Euro’s Inherent Flaws

Why a common monetary policy is problematic for the E.U.’s diverse economies

Visiting professor Ashoka Mody is the author of EuroTragedy: A Drama in Nine Acts, which unpacks the history and political motivations behind the European Union’s decision to employ a common currency, the euro. In a conversation with PAWcast’s Carrie Compton, Mody discusses the currency’s inherent flaws and its uncertain future — a topic that’s made headlines in recent days.

Listen on Apple Podcasts • Spotify • Soundcloud

This is part of a monthly series of interviews with alumni, faculty, and students.

TRANSCRIPT

Carrie Compton: Hi, I’m Carrie Compton, and you are listening to Princeton Alumni Weekly’s PAWcast. Today, our guest is Ashoka Mody, a visiting professor in international economic policy at the Woodrow Wilson School. Today we’re talking about his book, EuroTragedy: A Drama in Nine Acts, which unpacks the history and political motivations behind the European Union’s decision to employ a common currency, the euro. Professor Mody was deputy director for the International Monetary Fund’s research and European departments. He has also worked at the World Bank and has taught at the University of Pennsylvania’s Wharton School. Thank you for joining me today, Professor Mody.

Ashoka Mody: Oh, thank you very much for having me.

CC: So, let’s begin with a very quick tour of the empirical facts behind the history of how and why a single European currency was introduced, and how it has been justified at various points along the way.

AM: So the concept of a single currency emerges for the first time in any realistic form in late 1969. It’s a French initiative, the French have bristled for a number of years prior to that, feeling a sense of economic inferiority relative to Germany. A new French president, Georges Pompidou at that moment, decides that a single currency will eliminate the currency differentiation between France and Germany, and therefore the humiliation, the successive, periodic humiliation of devaluing the French franc, will mysteriously disappear. And that gets the ball rolling, that process then keeps going for the next 20 years; the Germans always say, ‘Yes, good idea, but not now,’ which is their way of saying no. They did not really want to say no to a French initiative. But then in 1989, the Berlin Wall falls, and Chancellor Helmut Kohl is at the helm, and he understands all the reasons why a single currency does not make sense, but at some point, he changes his mind. In my view, Kohl wanted to live in history as a chancellor of German unity. And also as a chancellor of European unity. And he therefore mysteriously decided that the euro was his vehicle to live in the history books. And so, he took the euro to the finish line between 1989 and 1999, over a period of a decade, during which the euro could have died many times. But we have this unique moment in history where Kohl is at the helm, he has enormous executive authority in Germany, he’s able to pull together the Germans on behalf of the Europeans and make a claim that this leads to a future that’s good for everybody, without defining how that would happen, and how the flaws would be overcome. And so you got the euro on January 1999.

CC: So talk about that inherent flaw, or the many inherent flaws that you see in that process.

AM: So the core flaw is very simple. That a single currency means a single monetary policy. The very diverse economies that are sharing a single currency, they have the same monetary policy. That monetary policy is likely to be too tight for the countries that are economically weak. That monetary policy is likely to be too loose for countries that are strong. And so, the weak country will be further handicapped by a tight monetary policy, the strong country will benefit, and just today, for example, the prospective German chancellor, Friedrich Merz, has said exactly that. He say that the euro is too strong for Italy and too weak for Germany. And that flaw was understood at the very beginning. Having understood that flaw, the task at hand was to create compensatory mechanisms, which means that either the weak country sends its people to work in the strong country, so that there’s migration like there is in the United States. If there’s a recession in one part of the U.S., there is some tendency for people to move to states where there’s less, where the economic activity is stronger. That doesn’t happen nearly to the same extent in Europe. So they understood that labor mobility, which is one possible compensating mechanism, does not work. Therefore, what was essential was to create a, what is called a fiscal union to support the single monetary policy. A fiscal union is, in effect, a federal budget, like the U.S. has. And the federal budget then is used to compensate. So if a country is in a recession, if the monetary policy is too tight for that country, the federal budget will transfer resources, like in the U.S. during the great financial crisis, global financial crisis that we recently had, the state of Nevada got something on the order of 20 percent of its GDP through various transfer mechanisms from the federal budget. That’s a transfer, pure transfer. They don’t have to pay it back. But that allowed them to recover relatively quickly. There’s no such mechanism in Europe. The only thing that did happen in Europe eventually was that Greece got, and other countries that were in crisis, got large amounts of official loans, but loans are not a transfer. Those loans have to be repaid. And in the act of repaying them, they have to then undergo several years of austerity, which prolongs the period in which they have depressed economic conditions, and that creates longer-term unemployment, it weakens the economy further. And that’s the fundamental flaw — which is that the weak country is further weakened, and the strong country continues to gain strength, and what was pointed out right in the beginning was that as a consequence, because the divergence will be amplified, the political divisions will also grow. An economist, very important economist of the 20th century, Nicholas Kaldor, said right in 1971 that because the single currency will amplify economic divergences, it will deepen political divisions, rather than coming together in unity; it’ll divide Europeans, and will pull them apart. That’s exactly what is happening now, that the financial crisis between 2007 and 2013 amplified the divergences, which have deepened political divisions, and today you see those divisions play out.

CC: Picking up on the founding principles of the unified currency, it sounds like they were fully aware of the consequences that are playing out today, but that there was a lot of wishful thinking involved.

AM: So the reason I ended up writing a history is to document exactly that. That often, people forget the history and they say well, “No, no, no, there was some good reasons for adopting the euro.” And my reading is that they were completely aware of the risks, and the wishful thinking came in imagining benefits. And there was a view that it will increase trade between European nations, which will increase prosperity, and again, very early on it was recognized that the mere fact of having a single currency will increase trade, if at all, by trivial amounts, and therefore will have no real bearing on trade or prosperity. And the evidence today shows exactly that. So you have a euro which does not bring any real benefits. But its risk are all too real. And so you are trapped in this situation where all along, the risks have been repeatedly documented, repeatedly stressed by some of the best minds in the world. But the wishful thinking has arisen in what I call a groupthink, a view that insulates itself from evidence against the project. And which allows the decision makers to continue as if that evidence of the flaws is somehow overstated or even misguided.

CC: I want to read something to you that you wrote in the book. I want to talk about Germany a little bit more. You write that “German economic disparities across nations has led to greater imbalance in political power. Germany became Europe’s undisputed economic leader, with veto power over the most important decisions for the whole of Europe. The German chancellor became the de facto European chancellor, albeit without the instruments that would make for effective and democratic decisions. Thus, the euro zone’s governance system became even less accountable than it had been.” So let’s talk about the fallout from that reality.

AM: Yeah, so this is the great irony, that the euro was supposed to unite Europeans. But at the moment of the crisis, there was a question of how to save the euro. Saving the euro required coming together in political unity. And Europeans were not ready to do that. And so, in effect, Chancellor Merkel took over the reins of Europe at that point by guiding the decisions. She was always very conscious of the German national interest, and therefore, her style of doing things was to pretend that there is no crisis, that it’ll go away. And so when it did not go away, at the last minute she would act, and do enough to prevent the crisis from morphing into a catastrophe, but then the crisis continued to brew in a lower-grade level, and it would pop up again, and again she would punt down the road. That has created an enormous sense of economic distress, because the crisis never got resolved in one clean swoop, but it also created enormous political distress in Germany; the Germans felt that she was doing too much for Europe. And so, you have the breakaway group, which is the Alternative for Deutschland, which originates as an anti-euro party with a number of senior leaders from the Christian Democratic Union, which is her party. So the people, not only Germans, but people very close, in a sense, politically and ideologically, to her party, move away and feel that she is doing too much for Europe. Those very same actions that Merkel is performing to try to save Europe are seen in Southern Europe, especially in Greece and Italy, as dictating policies to them. So she alienates both sides by the same action. One who feel that she is giving away German taxpayer money, another who feel that she is overriding their democratic institutions. There was, in 2011, an important set of decisions which led to the ouster of the Greek prime minister and the Italian prime minister. Merkel and her associates claim that she was not responsible for those ousters, but that is the general belief, because she was very closely associated with those decisions in some form. Whether she actually orchestrated them specifically is not clear, but that is the impression left. For nations where those prime ministers were democratically elected, that leaves a grievance. It leads to what sociologists call grievance nationalism. And you therefore create a grievance nationalism in the South, and a defensive nationalism in Germany, in an attempt to preserve German resources. And so that is how the original warning that the economic divergence will lead to political divisions actually manifests itself.

CC: Yeah. You talk about Italy as being one of the founding flaws of —

AM: Yes.

CC: — the euro, that it oughtn’t have been included in the beginning.

AM: Yes.

CC: Explain why that seemed inauspicious.

AM: So in the mid-1990s, there was a view that yes, it’s likely now that the euro will, in fact, happen. But that Italy does not belong to the euro zone. Economically, Italy had relied on the almost continuous depreciation of its currency. Italian inflation rates tended to be high, and if inflation rate is high, then companies in the country become less competitive, and the only way to regain some competitiveness is by depreciating your exchange rate. And the worry was that if you take away the currency devaluation, then Italians will not be able to survive inside the euro zone, which by definition would take away the devaluation option. There was also a political problem, and the political problem was that Italy, for a variety of historical reasons, had inherited a culture of pervasive corruption in public life. Short-lived governments, and the consequence was that there was no real reason to believe that these governments would, in fact, be able to get their act together and respond to the challenge that they could no longer depreciate their currency. However, a bunch of Italian technocrats, and some politicians, decided that in fact, they wanted to have the currency, the single currency, because they said without the crutch of the lira, which they could devalue, even Italian politicians would be forced to improve the policy-making structure in Italy, and that force would then lead Italy to increase its productivity growth, and the need for exchange rate depreciation to regain competitiveness would go away. The theory was cute, but it didn’t happen.

CC: Right.

AM: They gave up their currency, and their productivity growth became negative. And so Italy has not grown between 1999 and 2018. Italian per capita income is lower today than it was in 1999. The average Italian therefore is poorer today than he or she was 20 years ago. On top of that, Italy already, even before the euro, already had high indebtedness. The Italian government, Italian banks were chaotic. None of that has changed in a material way, Italian debt today is larger than it was at the time, in relation to GDP, larger than it was at the time the euro was introduced. Italian banks are fragile. So Italy does not grow, Italians have lots of debt to repay, Italian banks are always on the edge. Therefore, a shock to Italy is likely to create very broad-ranging effects. I call Italy the fault line of the euro zone, because an Italian crisis could send tremors right through Europe. So you’re — at this stage today, where Italy is again the one that is in the spotlight, because its problems are perennial, and because Italy is so big. Just to give you an order of magnitude, Italian economy is about eight times bigger than the Greek economy.

CC: Oh wow.

AM: So already, they had a problem trying to solve the Greek financial crisis. An Italian crisis is at least eight times bigger.

CC: Oh.

AM: Another number: The Italian government’s debt is about the same size as the German government’s debt. About two and a quarter trillion euros. The Italian banking system is almost the same size as the German banking system. In other words, if Italy has a crisis, it’s not clear that the Europeans have the resources to bring together a resolution of the crisis in the way that they were able to do to resolve the Greek crisis. There are instruments and principal available at the European Central Bank, but as I discuss in my book, those instruments are extremely politically susceptible that their deployment requires eventually a degree of political coordination, and willingness to deploy them. We are at a very, again, at a very critical juncture in the evolution of the euro zone, and therefore, of Europe.

CC: So at this point, what sort of policy recommendations are there? Doing away with the single currency is probably not going to work.

AM: Yes, you’re quite right. Doing, one of — I joke sometimes that the euro’s great success is it’s so hard to break up. The breaking up the euro, for example today, if Italy were to leave the euro zone, the Italians would then earn in liras. But they would still owe their debts in euro. So if you needed two liras to buy one euro, then a 100-euro debt will now suddenly become a 200-lira debt. And there would be defaults on those debts, which would mean that the creditors who are no longer receiving the funds that they expected will default on their creditors. And so you will have cascading defaults. And because, as I said, the banks are large, the government debt is large, those cascading defaults could have extraordinary wide-ranging implications, not just for Italy, not just for Europe, but for the entire global financial system.

CC: Wow.

AM: There are palliatives in the short run, which essentially deal with smoothing out the functioning of the euro zone. For example, the European Central Bank relies too much, or focuses too much, on price stability. Which keeps the monetary policy relatively tight, that tightness of monetary policy creates deflationary conditions in the southern countries. Deflation being the expectation that prices will either not rise, or will rise at a slow pace, which causes consumers and investors to postpone their decisions, which slows growth, increases the debt burden. And so, I visualize a possibility that Italy comes to the threshold where it is almost ready, or being forced, to exit the euro zone. And what I say in the book is that if we reach that stage, and there is a reasonable possibility that we may reach that stage, maybe not right now, but at certain point in the future, then the only safe way, or the least unsafe way, of breaking up the euro, is by Germany exiting. Germany is the only country that can exit the euro zone, bear a huge cost itself as a consequence, but absorb that cost within Germany, without exporting the crisis to the rest of the world. Any other country exiting the euro zone is likely to create a problem, not just for itself, but for Europe and potentially for the world economy. So, the Germans will need to make a decision, yes we are going to lose a lot of money as a consequence of having to break up the euro, of us exiting the euro, and going back to the deutschemark, but if we don’t do that, there’s the risk of a much greater cost to Europe and eventually therefore, also to us through the backlash that occurs through another country exiting the euro zone. I think that there is a reasonable likelihood that something like that in the coming years may be a decision that Europeans will have to make.

Today, it’s one of those ideas that is considered unthinkable, not least because Germans believe that they are the original conceivers of this project, or they have at least been a central element to the project, that they have a political investment in the project. And therefore, their exiting somehow is a loss of political face.

CC: Interesting. You also talk about increasing focus on education as a prescriptive measure.

AM: Yeah.

CC: Talk about that.

AM: So what I say is that the obsession with the euro has distracted Europe from its real problems. Today, because the euro figures so centrally in day to day financial and economic policy decisions, Europeans tend to forget that their real problem is that they are economically declining continent. That in terms of education, research, patenting, innovation, Europeans are steadily declining, falling behind the world leaders. The United States, for all its problems, continues to have the world’s best university system, and its R&D [research and development] and innovation systems remain the benchmark for the rest of the world. East Asian countries, Korea, Taiwan, and of course Japan, and now increasingly China, are catching up. And you can see that that’s, that package of education, R&D, patenting, in the lead nations and the Europeans falling behind. Especially France and Italy. And I say education is twice blessed: Education is blessed because it is the only long-term source of growth that we know is reliable, since the Industrial Revolution to today, that’s been the one correlate of growth that is almost an inevitable source of growth, and the growth fills back on investment in education. Education is also the only reliable way of creating a sense of intergenerational mobility. So, paradoxically, even though Europeans have a very large welfare state, one of the things they are falling behind on is upward social mobility. That lack of upward social mobility, particularly acute in France and Germany — France and Italy, is the source of the populist movements. When people feel that they are being left behind, where their old professions are disappearing, and their children will also not have opportunities in the future — they then become receptive to various nationalistic and xenophobic rhetoric. And the birth of these so-called populist, which I call protest anti-establish movements, is generated, at least in large part, because of a sense of economic frustration. And the only real way of dealing with it is to create a vast amount of educational opportunities. The real problem is domestic, solving the domestic problem and creating a new generation of Europeans who grew into that confidence is, I think, ultimately both good for Europe in any case, and good for the notion of preserving the single currency.

AM: The prognostication is hard. Because you know, you can predict history, but you cannot predict the timing of history.

CC: Sure.

AM: I think that the, what the euro has revealed is a sort of deeper democratic deficit in Europe. I mean, just to give you one example of that, which is that Greece has come out of its bailout program, so Greece is no longer now receiving loans from official creditors in Europe. That has been a matter of great relief, and indeed of some celebration. But it’s very premature to celebrate, because Italian GDP is still about 25 percent below its level before the crisis. It’s a, the extent of the depression increase is virtually unprecedented in modern living history, other than in extraordinary cases, which are driven by crime and war. But a deeper problem for Greece, other than hopefully the, a potential economic recovery, is that Greek democracy has been deeply compromised. Greece now owes a lot of money to its official creditors in Europe. And because it owes them a lot of money, it is going to be held on a tight leash for the next 20, possibly 40 years. In other words, the Greek parliament will not be able to make any tax or spending decisions without them being authorized by Brussels, and Berlin, and Frankfurt. Which in effect means the Greek parliament will in some sense by a hollow institution. When the Greeks vote for their parliament, they will not, in effect, be voting for somebody who has the authority to take decisions on their behalf. The decisions will still be made somewhere else, so it’s not clear who the Greeks will be voting for. And that is the most regrettable outcome of the euro, is that it has created a system within which a country can completely lose its democracy. I think this is one of those clear cases where the grievance nationalism will continue to brew for many years. There’s a reason to fear that there will be a backlash in Greece in the years to come, which would be hard to contain.

CC: So the bloc would have almost been better off without it.

AM: There’s no question that the euro was a bad idea in every way. It was bad economics, it was bad politics. And the only thing we can say for it today is that perhaps the cost of breaking it up would be so great that we need to try to hold it together. There will always be an inherent tendency in the euro system to pretend that a crisis does not exist, so to first deny it, then delay the response, and the denials and delays will cause the crisis to fester, and become worse. The original economic wound will leave scars. Over time, these scars, through successive crisis, will continue to build. So maybe the euro zone will not break up in any sort of short horizon, but as long as these scars continue to build, the social and political fabric of Europe will continue to be undermined. And that, I think, will eventually end in a way that could make everybody very unhappy.

CC: Interesting. Well thank you very much—

AM: Thank you very much.

CC: It’s been wonderful talking to you.

Paw in print

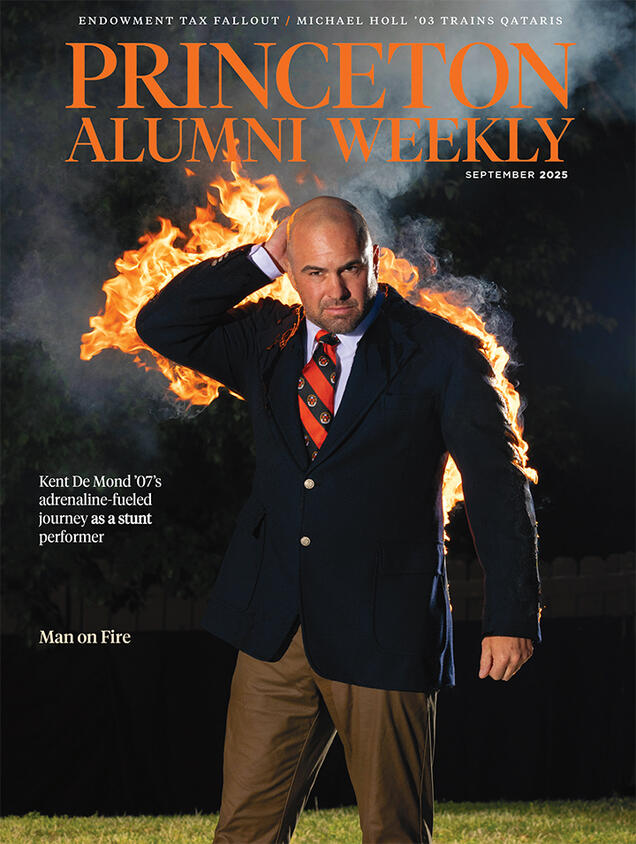

September 2025

Stuntman Kent De Mond ’07 is on fire; Endowment tax fallout; Pilot Michael Holl ’03 trains Qataris

1 Response

Osita Iroku

6 Years AgoThe Failure of Globalization

This is an extremely important thesis, which shatters the illusion that globalization (as it has been carried out during the New World Order) has been rational, fair, or sustainable. In summary, according to this interview, the greatest example of its failure has been the euro. The proposal for it came from France in late 1969, for very selfish reasons, to eliminate the periodic devaluing of the French franc. The Germans resisted for decades, because it was obvious that a single currency means a single monetary policy across very diverse economies, which is likely to be too tight for some, and too loose for others. An economist, Nicholas Kaldor, said in 1971 that “because the single currency will amplify economic divergences, it will deepen political divisions, and rather than uniting, it’ll divide Europeans, and pull them apart.” Yet, after the Berlin Wall fell, Kohl wanted to be remembered as the one who reunited both Germany and Europe; so he rallied the Germans and Europeans to launch the euro in 1999. Unfortunately, as predicted, the global financial crisis between 2007 and 2013 amplified existing divergences, which deepened political divisions, and today you see those divisions playing out in the rise of ethnic, nationalistic, and populist revolts.

The solution would be to create compensatory mechanisms, like free labor migration (labor mobility) across the union; and/or the free transfer of resources as needed across the union, without onerous repayment or restructuring terms attached. In contrast, the EU resisted migrant workers and gave out loans that had to be repaid under several years of austerity. This poor strategy prolonged the depressed economic conditions across the continent, which will continue to have a ripple effect in the virtual collapse of one global institution after the next.