PAWcast: Professor Ashoka Mody on COVID-19’s Impact on World Economies

Falling GDPs could lead to sovereign defaults, according to the visiting economics professor

Listen on Apple Podcasts • Google Podcasts • Spotify • Soundcloud

TRANSCRIPT

Carrie Compton: Hi, I’m Carrie Compton and today we’ll be revisiting a conversation from the beginning of 2019 that I had with Woodrow Wilson School Visiting Professor Ashoka Mody, a former deputy director at the International Monetary Fund’s Research and European Departments. In our last interview, Professor Mody described his findings from his book, Euro Tragedy: A Drama in Nine Acts, in which he questions the political and financial wisdom behind the creation of a single European currency and monetary policy. An updated and extended paperback edition of the book has just been released. Today, in light of a looming economic crisis caused by the COVID-19 outbreak, Professor Mody joins us again to briefly discuss what’s at stake for Europe and the United States’ economies.

Thank you so much for joining us again.

Ashoka Mody: You are very welcome.

CC: Describe for us what the outbreak means for global trade, considering that it debilitated China and Europe as it has.

AM: Unlike the influenza pandemic of 1918 to 1920, the world economy is extremely globalized. And, even more importantly, the most important nodes of global trade have been impaired by this crisis. China is the most important node. China has been the center of global trade for the last two decades. The Chinese economy comes to a grinding halt in the first couple of months of this year. Chinese exports and imports declined precipitously. And that means that China imports less from other economies, which means those other economies sell less to China, but then they import less from others. And so, there’s a knock-on effect from China, which then spills around the world. But what also happened was that the disease then went to Europe and European economies are the other major, big nodes in global trade.

CC: Right.

AM: So, what this means is that, as long as major nodes in the world trade network are impaired, even if one or another country begins to recover, the fact that the others are not recovering will imply that the world trade will continue to be weighed down.

For example, we are now hearing that the Chinese economy is getting back on its feet, and the Chinese authorities are trying to push out some of the exports that were already waiting in their ports. But for all of that to work, there must be somebody at the other end to receive those products. The Chinese factories, when they begin humming again, will need to sell their stuff abroad because, again, China is so dependent on world trade.

As long as Europe remains under the grip of the virus and the European ability to receive these goods is going to be limited, their ability to export to others will be limited. And that’s going to cause world trade to remain very subpar for the next, in my mind, at least six to nine months.

Now, I’ve focused on China and Europe because they are so large. But this also implies that a number of so-called emerging markets like Mexico, Turkey, Argentina, Indonesia, to some extent India — they will all have drags on their economic growth because of their linkages to world trade. And while the United States tends to be somewhat insulated from world trade because it’s got such a large domestic economy, eventually or probably already, the U.S. is also going to get affected by this.

CC: Right, right.

AM: We have two crises going on. We have a domestic crisis, which is because people are not able to go to work, people are not able to gather. That’s a domestic crisis. But because it also gets linked to international trade, that domestic crisis gets amplified into the global economy.

CC: Is there any — upside probably isn’t the right word — but is there any upside to the fact that the crisis is so global? Might it mean greater international cooperation for recovery?

AM: Now, this is a moment when global cooperation should, in fact, be very high on the agendas of policymakers. But, in practice, what we are seeing right now is that it’s everyone for themselves; there are good reasons and bad reasons for this. The good reason is that the nature of the domestic incidents of the disease and the problems that they need to deal with at home in terms of hospitalizations and protective gear and all that is a national problem. There isn’t very much that people can do in terms of helping there, although there is, even on that, there is this whole question of exporting protective gear. So, there have been shortages and, in Europe, there have been some reports that countries are not exporting protective gear to each other because they want to keep it for themselves.

China seems to have sort of stepped into that breach, and the Chinese are trying to sell some of their extra production to, particularly, the Europeans, both because it makes economic sense but it also wins them diplomatic brownie points.

On that front, it still, in my view, has to be primarily a domestic response. Then, the question is, on the economic policy side, can there be international coordination? And, for the moment, the fact that there is not more international cooperation, at one level, is all right, because as long as each country pursues an extremely aggressive monetary policy and fiscal policy response to counter the economic effects, then even though we do not have a formal coordination, there is an implied coordination because everyone is, so to say, putting their shoulder to the wheel.

Where the problem arises is in Europe because there the imbalance between the damage done by the crisis is great. So, Italy, particularly, but also increasingly Spain have been hurt a lot more than Germany and the Netherlands or even France up until now. Before I explain to you what’s happening in Europe, just step back and see what’s happening in the United States because this gives a perspective on what the Europeans, in principle, need to do.

CC: Yeah.

AM: So, the stimulus package that was agreed on in the United States: The federal government does a number of things to help the states. So, there is a very depressing lack of coordination going on on the medical front over here — all the fights about the ventilators and so on, both disgusting and depressing. But on the economic policy side, the federal government stimulus, will top up the states’ unemployment insurance. There is a large provision in the stimulus package to give states money to help them with the sort of physical effort of building hospitals and other supply channels or whatever they need to deal with this crisis. In Europe, none of that is happening because the Germans are the Germans and the French are the French and the Italians are the Italians. There is no federal government in Europe.

Europe is like the United States was between 1776 and 1787: a confederation of states. The federal government in the United States at that time was extremely weak and each state pretty much did what they wanted to do. And there was no ability or incentive for the federal government to help. There is a famous story that New York State used to get large revenues through import tariffs which were levied on goods coming in through New York. And the federal government desperately needed to pay wartime debts and pay pensions of soldiers and New York State said, “Now, why exactly would we help you pay that?” So, that was sort of, in a sense, the spur that caused people like James Madison to say, “This confederation setup is going to just tear us apart, and we need to create a federal state.” In Europe, that never happened.

CC: Right.

AM: And so, each state has its own fiscal authority with no legal obligations to other states. So, they need to coordinate. There is a huge problem because the question, you know, which I talked about in my book, EuroTragedy, has always been: “Now, why exactly will we pay your bills?”

CC: Right.

AM: There is one line of cooperation, coordination going on, which is through the European Central Bank. The European Central Bank is the central bank of a confederation of states. But it can print money, and it is printing money or it has promised to print money, something of the order of 750 billion euros just for this pandemic effort in addition to about 250 [billion euros] or odd that was already in the pipeline.

So, this 750 [billion euros] is, in principle, supposed to buy the bonds of European governments. The goal is twofold. One is that, to the extent the ECB buys the bonds of European governments, that will help keep the interest rates on those bonds low because the demand for those bonds goes up and so the interest rate will remain low.

But there is also a more sort of direct problem, which is that — take Italy, for example. The Italians already owe something like 2.5 trillion Euros of debt, which is about 135 percent of their GDP. If their GDP is falling, which by — we know that their GDP is falling. We don’t quite yet know by how much but it could well fall by, you know, anywhere in the range of 8 to 10 percent over the coming months, which means that their ability to repay their debt obligations will come under a huge amount of strain because as their GDP falls, their tax revenues will fall, their requirements to spend on unemployment insurance will increase. And, therefore, they will be extremely constrained fiscally and their ability to repay their debt, therefore, will come under a great deal of market anxiety.

And so, then, the ECB can, in principle, step in. In effect, they will basically say, “If you cannot get money from other creditors or if you need to repay your other creditors, we will do that for you.” So, the ECB can keep Italy and Spain afloat for a while. Here in the United States, also, the Federal Reserve is similarly buying the bonds of U.S. Treasury.

CC: Right, right.

AM: But here — and this is, again, why a federal state is different from a confederation of states — here, if for some reason — this is not going to happen, let me just be clear — but if for some reason the ECB, having bought the bonds, having bought the U.S. Treasuries, suffers a loss on those treasuries — in other words, having bought them, the price of those treasuries goes down and so the Federal Reserve loses money on them, then the U.S. Treasury will have an obligation to make up that loss through their budget. So, over the coming years, the U.S. Treasury will then have to raise taxes and quote-unquote repay the Fed so that the Fed’s capital is not reduced.

CC: OK.

AM: In Europe, suppose the European Central Bank buys several hundred billion Euros of Italian debt. Now, first of all, remember several hundred is not enough because they have 2.3 trillion debt. So even if they buy several hundred, there will come a point at which ECB will become the largest creditor, largest lender to the Italian government, at which point it’ll look almost like the ECB owns Italy.

CC: Wow.

AM: And at that point, then, if the question arises, the ECB in effect owns Italy and the Italians now cannot repay the ECB, then the ECB will suffer a loss which will leave a hole in the ECB’s capital which the Germans and the Dutch and the Austrians and the French will all have to fill.

CC: Oh, my goodness.

AM: So, they are not speaking this language as yet, but that is what is in their heads right now. At what point do we pay the bills that the Italians need to pay? So, just to give you one last bit of sort of quantitative information: As I said, the U.S. government, as part of the stimulus package, is giving money, I think, something in the range of $150 billion to the states. Remember, these are not loans. These are just grants. If the same thing were to happen, the Italians should be receiving 200 or 300 billion euros of cash right now from the rest of Europe.

CC: Wow.

AM: But that kind of money would be politically explosive in Europe.

CC: Sure.

AM: No one even dares to talk about it. I’m giving it to you as a number just to put it in perspective that that is probably the scale of money that the Italians need, not as a loan but just as a grant.

CC: Wow. Do you think that that will happen?

AM: No, I don’t see how that can happen. I just — I mean, you know, anything can happen but the likelihood that something like that will happen is just negligible in my view. At some level, the crisis that the globe is facing is similar, the financial crisis, which is that the slowing world trade is affecting everybody. We came into this crisis with a large mountain of debt that we owed. That mountain of debt had accumulated over the last 10 years because interest rates were very low. And so, households and companies and banks and governments busily borrowed because the interest rates were so low.

This is sort of a classic pattern that when interest rates are low, debt levels go up. And they had gone up to historical heights. So, we came into this crisis with a historically high debt burden that affected virtually every country and virtually every kind of borrower. Suddenly, now, just think of it: You’ve borrowed a gob of money and suddenly you know that over the next year, your income is going to be 10 or 15 percent less than what you thought it’s going to be.

CC: Right.

AM: So, you are much more indebted than you have ever been and your income is falling much more than it ever has. And that is the situation we are in right now. So, we are moving into a situation, A, where even with the enormous amount of policy support that the Federal Reserve, the U.S. Treasury, in the U.K., the Bank of England, and the U.K. treasury, and the Europeans — to not quite the same extent but by their standards, to a considerable extent — are doing.

Nevertheless, there will be, at some point, people who will begin to default on their debts in the next, you know, six to nine months. And when those defaults occur, then the financial system of the world will begin to show strain and anxiety in the markets. And once defaults start, it’s sort of a very tricky business because if I default on a loan that I have taken from you, you are not able to repay your creditors, and so it goes up the daisy chain up until it reaches some large lender, like a pension fund or insurance company, where sort of the big, big pockets of money are. But then, if people start defaulting on the loans that they have made, then their ability to pay out pensions and insurance claims is compromised. I’m not saying that we will reach there. What I am saying is that that scenario exists as a small but real possibility.

CC: I believe most people think that there will be more stimulus coming beyond what was approved. What does that mean for the United States debt?

AM: So, I think more stimulus will be needed. It means that there will be more debt but that debt, in principle, for the United States — and this is not going to be true for every country but in the case of the United States, they still have very low interest rates, the nominal interest rates, and then eventually, if the scenario of high inflation or higher inflation materializes, then, with the higher inflation, the tax revenues will also increase to repay that debt. So, you repay your debt — two factors make it easier to repay your debt: Either the interest rate is low, which it is, still, or the inflation is high, which is not the case now but could become high. And so, that combination of relatively low interest rates [an] relatively high inflation will eventually help repay that debt.

This may not be true in Italy and even in Spain, potentially, because before all of that happens, they might just not be able to repay their debts. I have been, you know, concerned about Italy’s ability to repay its debts even in better circumstances. In these circumstances, I certainly am very concerned. One of the world’s preeminent sovereign attorneys, a guy named Lee Buchheit has written a piece saying that there are going to be lots of sovereign defaults in the coming months.

CC: Wow.

AM: And it’s a judgment which intuitively makes sense.

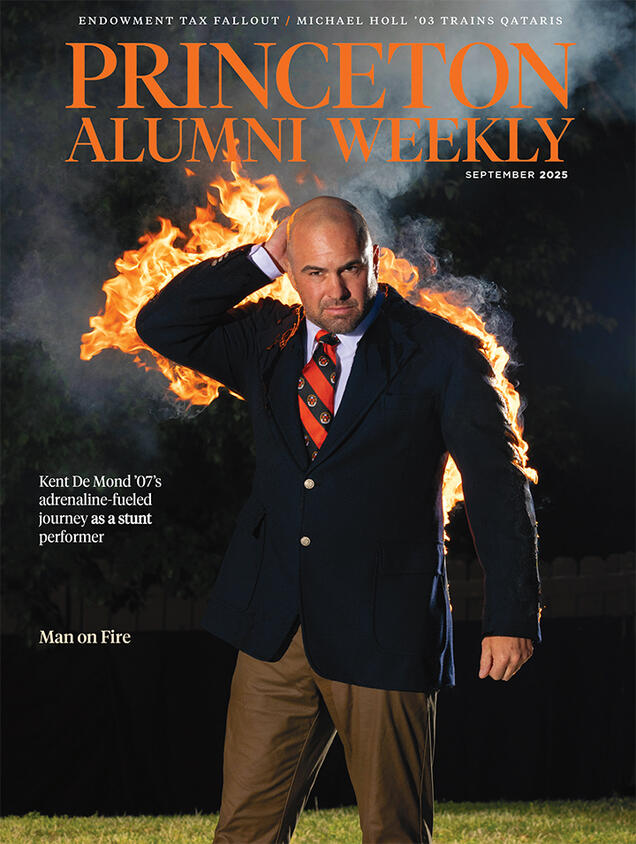

Paw in print

September 2025

Stuntman Kent De Mond ’07 is on fire; Endowment tax fallout; Pilot Michael Holl ’03 trains Qataris

1 Response

William H. Plauth Jr. ’53

5 Years AgoA Sick Economy

A very clear and believable explanation of the current situation facing the European Union and its members. Will the USA, Britain, or any other industrialized nation be willing, able, or even interested, in assisting with the solving of the problems Professor Mody has described? It looks like a long hard, dangerous road ahead to this old guy. And now — “Here's the Pandemic!”