Princeton Endowment Earns 11% Return, Reaches $36.4 Billion

Princeton University’s endowment reported an 11% return on investments for the 2025 fiscal year, its best performance in four years.

“These returns will enable Princeton’s ongoing support for groundbreaking research, innovative scholarship, and leadership on student access and affordability,” Princeton spokesperson Michael Hotchkiss said in a statement to PAW.

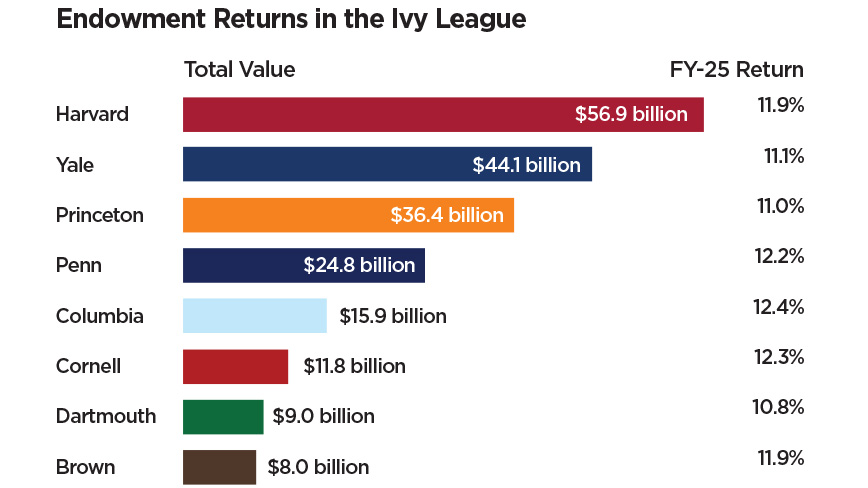

The endowment totaled $36.4 billion when the fiscal year ended in June. It remains the third largest in the Ivy League behind Harvard ($56.9 billion as of June 2025) and Yale ($41.4 billion in June 2024).

Peer schools had similar endowment gains in 2025, with MIT, Stanford, and Harvard announcing returns of 14.8%, 14.3%, and 11.9%, respectively. Yale has not yet published its return for the fiscal year. Pensions & Investments reported that the median for the 39 college and university endowments it tracks was 10.8% as of Oct. 24; each of the six Ivy institutions that have announced returns matched or exceeded that median.

The Princeton University Investment Co. (Princo) reported a historic 46.9% return on endowment investments in 2021; since then, Princo reported losses of 1.5% and 1.7% in 2022 and 2023 and a 3.9% gain in 2024. The average annual return on the endowment has been 9% for the last 10 years and 9.5% over the last 20 years.

The endowment provides about two-thirds of Princeton’s net annual operating revenues. Endowment payouts also cover almost 70% of undergraduate financial aid and 53% of the overall student aid program, which benefits about 70% of undergraduates and virtually all graduate students, according to the University.

In future years, the impact of Princeton’s gains may be tempered further by taxes. Princeton is subject to a 1.4% tax applied to the largest university endowments, and Congress passed an increase in that tax rate in July. Starting in the 2026-27 fiscal year, institutions with endowments above $2 million per student and with “at least 3,000 tuition-paying students” will be subject to an 8% tax on endowment returns, according to the statute.

2 Responses

Michael E. Morandi *83

2 Months AgoEndowment Performance

Despite much fanfare, Princo has underperformed public markets, and its illiquid investment portfolio forces the University to borrow in a crunch. And who knows what the illiquid assets are worth anyway, as they do not trade frequently. We would be better off investing with the great Jack Bogle ’51’s low-fee index Vanguard.

Howard Schulman ’86

2 Months AgoPrinco’s Private Equity Investments

I would like to know approximately what percentage of the Princeton University endowment is placed with private equity organizations. If possible, could you tell me what return the University realized with money placed in private equity?

Could you also give me an explanation of how a private equity company is defined, as opposed to a company that invests money?

Editor’s note: According to the University’s Financial Statements, as of June 30, 2025, $14.7 billion of managed investments (about 40%) were in private equity. Princo did not publicly report annual returns by asset category.